Ewa Beach Branch Grand Opening

Connect with great savings at our new branch in Ewa Town Center.

Bank easily with more parking and convenient Saturday Hours.

Now, it’s easier than ever to bank and run errands at the same time. Come in and see our familiar warm smiles and check out our special Grand Opening offers below. Either way, we can’t wait to connect with you.

Pure Checking

Open a new Pure Checking account at the First Hawaiian Bank Ewa Beach Branch and get a $10 Foodland Gift Card.*

- No minimum balance requirement

- $20 minimum opening deposit

- No monthly service charge with eStatements[[#1]]

- FHB Online[[®]] and Mobile[[#2]] Banking including Mobile Deposit

- Standard Debit Card

Valid July 19 - August 14, 2021

Business Checking

Open a new business checking account at the First Hawaiian Bank Ewa Beach Branch and your monthly service charge will be waived for the first 3 months.[[#3]]

- $100 minimum opening deposit

- FHB Online[[®]] and Mobile[[#2]] Banking for Business[[#4]]

Valid July 19 - August 14, 2021

Home Equity Line of Credit

Pay down high-interest bills, remodel, or refinance.

- 1.25 APR[[#5]] Fixed for 2 years. Intro rate with FHB Auto Payment

- 4.82 APR[[#5]] Current fully indexed rate as of 7/1/2021

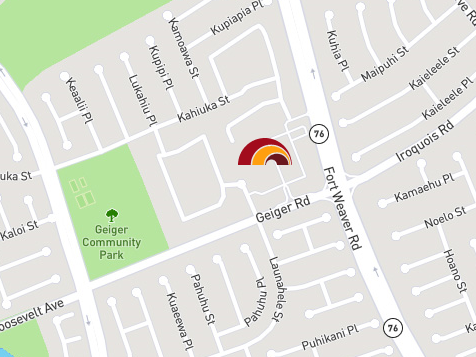

Come see us in Ewa Town Center.

91-1401 Fort Weaver Road

Suite D101

Ewa Beach, HI 96706

* Receive a $10 Foodland gift card when you open a new Pure Checking account at First Hawaiian Bank Ewa Beach branch by August 14, 2021. This offer is valid at First Hawaiian Bank Ewa Beach branch only. Offer expires August 14, 2021, or when supplies are exhausted. This offer cannot be combined with any other promotional offer. Limit of one gift per customer or account. We reserve the right to substitute for an item of similar value. Business and corporate accounts do not qualify for this offer. Accounts with a zero balance for 30 consecutive days will be closed automatically. Accounts closed within 180 days of opening will be assessed a $50 fee.

- When you enroll in eStatements, you will no longer receive paper statements. If you choose to receive both paper and eStatements, a fee of $5 will be imposed each month.

- For additional information about FHB Online and Mobile Banking, including fees associated with optional services, please see Terms & Conditions of FHB Online. You must have a mobile device with internet to use FHB Mobile Banking and a rear-facing camera with autofocus to use Mobile Deposit.

- The minimum deposit to open a business checking account is $100. The monthly service charge on your new business checking account will be waived for the first 3 months from account opening. After the first 3 months, a monthly service charge may be assessed. Refer to the Schedule of Charges and Other Information for Business Deposit Accounts provided at account opening for the monthly service charge. Accounts with a zero balance for 30 consecutive days will be closed automatically. Accounts closed within 180 days of opening will be assessed a $50 charge. Limit of one offer per customer or account. This offer cannot be combined with any other promotional offer. This offer is valid at the First Hawaiian Bank Ewa Beach branch only.

- Enroll in either FHB Online Business Basic or FHB Online Business Banking. FHB Online Business Basic includes basic online banking features, such as eStatements, transfers and mobile check deposit, and is free to business customers. FHB Online Business Banking includes basic features as well as Online Bill Pay, Popmoney and Entitlements. FHB Online Business Banking is free for Business Priority Banking customers and is $5.99 per month for all other business customers. Entitlements for FHB Online Business Banking includes 2 sub-users and is an additional $1/month per sub-user after the first two. For businesses using Direct Connect to access online banking through Quicken® or QuickBooks®, it is $14.95/month used (fee is inclusive of the FHB Online Business Banking service fee. Priority Banking waivers not applicable). See FHB Online Terms and Conditions for details.

- If you choose to enroll in automatic electronic fund transfer payments from a First Hawaiian Bank personal checking or savings account to pay your monthly payments (“Auto-Pay”) before final credit approval, the promotional 1.25%, 1.75%, 2.25%, and 2.75% Annual Percentage Rates (APR) for the variable rate portion of your credit line will be fixed for 24, 36, 48, and 60 months, respectively, from account opening (the “Auto-Pay Promo”). If you choose not to enroll in Auto-Pay before final credit approval, the promotional 1.50%, 2.00%, 2.50%, and 3.00% APR for the variable rate portion of your credit line are fixed for 24, 36, 48, and 60 months, respectively, from account opening. You are not required to enroll in Auto-Pay to open or maintain your Credit Line. Participating in Auto-Pay merely makes the Auto-Pay Promo available to your Credit Line. After the applicable promotional rate period ends, the APR for the variable rate portion of credit line may vary and will be adjusted monthly to 1.50 percentage points over an index, which is The Wall Street Journal Prime Rate, except that the APR will never be lower than 4.50% and will never be higher than 19.00% for Hawaii. The current fully indexed variable APR is 4.82% as of 7/1/2021. Except for any Auto-Pay discount, no other discounts apply to the promotional fixed rates. The APR after the promotional period will be 0.25 or 0.35 percentage point lower if you have a personal Priority Banking Checking Account Level 2 or Level 3, respectively. Both the promotional APR and the APR after the promotional rate period will be 0.50 percentage point higher for investors and for lines secured by a second home, and 1.00 percentage point higher for leasehold (owner occupant only) properties. Other adders may apply. You must carry insurance on the property that secures the credit line; flood insurance is required if the property is located in a special flood hazard area. For Hawaii, most closing costs waived for owner-occupants, investors, and lines secured by a second home, unless an ALTA policy, appraisal services fee, trust review, or preparation of other legal documents is required. These closing costs are estimated at $750 – $3,557 (ALTA policy), $275 – $2,285 (appraisal services fee), $260 (trust review fee), $150 (private flood insurance policy review fee), and $225 – $475 (legal documentation). Other closing costs may apply and the fees quoted could be higher, depending on your specific credit line. There is an annual fee of $100, which is non-refundable and will be charged to your credit line on each anniversary date of your credit line account during the ten (10) year Draw Period. The annual fee is waived if you have a personal Priority Banking Checking Account Level 3 at the time the fee is assessed. An annual fee is not assessed during the twenty (20) year Repayment Period after the Draw Period. Offer subject to credit approval and good for new approved Home Equity FirstLine applications received from 7/1/2021 to 8/31/2021. Credit line account must be opened within 60 days of application date. Refinancing of existing First Hawaiian Bank loans, lines of credit or credit cards, and Home Equity FirstLine locks, personal lines of credit, and lines to purchase and install a new photovoltaic system, do not qualify for the rate offer. Only credit lines secured by Hawaii properties are eligible. Cannot be combined with other special rates or promotions.