Digital Banking FAQs

General

Go to our Support section for detailed instructions on how to Update Your Username or Password.

If you forgot your password, you can reset your password online by clicking on the "Forgot Your Password?" link at fhb.com or using the FHB Mobile app. We will ask you to verify your identity via security code or by answering your security questions.

If you forgot your username, you can use the "Forgot Your Username" link at fhb.com or on the FHB Mobile app, to recover your username. A link will be sent to your email address on file and you will be sent a security code via text or phone call to verify your identity. Once verified, your username will be displayed.

If you have already tried this and still need assistance, call 643-4343 (1-888-643-4343 from the Continental U.S., Guam, and CNMI). Too many failed login attempts will lock you out of your online banking account.

Once logged in to FHB Online, go to "Settings" then click "Profile". There you can update your email address and phone number. If you would like to change the address on any of your accounts, please Send a Secure Message in FHB Online by clicking the "Messages" link. Select "Change of Address" from the subject line drop down menu, then include your new address and each bank account that should be updated with the new address.

Go to our Alerts & Notification page for detailed instructions on how to Create and Manage Your Alerts

The current balance is the total amount of funds in your account. The available balance is your current balance less any outstanding holds or debits that have not yet posted to your account.

With Online Banking you will be able to view 45 days of history for your deposit accounts; however, credit card accounts will show only history from the day you enrolled. As transactions post to your account, you can view them going forward. You will eventually be able to see as much as 36 months of past activity and 7 years of eStatements on your accounts. The amount of account activity information may vary when accessing the information via Quicken/QuickBooks. The FHB Mobile app displays up to 90 days of transaction history.

If you need immediate attention, such as technical issues, stopping a payment on a Paper Check, reporting a lost or stolen card, or reporting an unauthorized transaction from one of your Accounts, call us at 844-4444 (or 1-888-844-4444 from the Continental U.S., Guam, and CNMI). For all other inquiries, please contact us through the Message section of your FHB Online service and we will respond within a few business days.

CheckImage[[SM]]

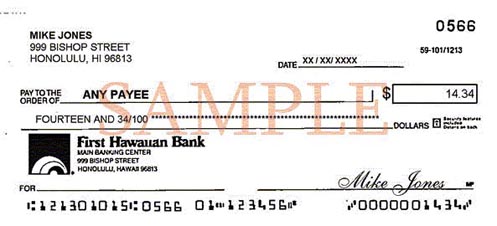

Sample of CheckImage Front

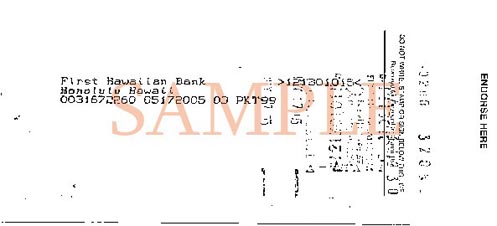

Sample of CheckImage Back

No. Online check images are provided as an additional service to assist you with your banking needs. This will not change the way you currently receive your statements.

Images of cleared checks are available in the Account Details section by clicking on the check number of the check you wish to view. You then have the option to view or print both sides of the check. Special software is not necessary to view check images online. However, we do recommend that you disable any pop-up blocking software enabled on your web browser.

CheckImage is available to all customers enrolled in FHB Online service allows you to view and print images of the front and back of checks that have cleared your Checking account. Online check images through FHB Online are usually available within one business day after the checks have cleared your account. When you enroll in FHB Online, you will automatically have the ability to view images of checks online for no additional cost.

Images of checks that you have written are available through FHB Online as long as the check transactions appear in your Account Details. Special check image requests can be requested by sending us a Secured Message through FHB Online.

Trust, Investments, and Insurance Accounts

Insurance policies don’t typically have a “balance.” Depending on the type of policy, they may have a cash value but this information is not displayed. Please contact your Account Officer if you have questions about your policy.

Although TotalWealth[[®]] and FHB Online both provide online access to wealth management account information, the available information and features are different. Please contact your Account Officer to discuss which service may best fit your needs (e.g., if you are a business customer).

Go to the enrollment page and follow the instructions to determine the best enrollment process for you.

Once enrolled, you will be able to view a list of your organization’s accounts and balances, but you will not be able to view detailed information on the accounts. If you would like access to more information, please contact your Account Officer to discuss alternatives that may be available to you. If you need assistance with identifying your account manager, please call 808-525-7027 for assistance with your Wealth Management Account.

MoneyMap

Yes, the majority of FHB Online MoneyMap features are available through the FHB Mobile app, with the exception Goals, Trends and Cash Flow. Those features are exclusively available through FHB Online. FHB Mobile also offers Insights which provides personalized insights on your transactions to call out unusual activity such as duplicate payments, a new subscription, high than normal spending in a category and much more.

Yes, once in MoneyMap click on the Transactions tab. Then on the “Export CSV” option toward the right of the screen.

If you recently deleted the account from MoneyMap and are trying to reconnect it, we suggest waiting at least a few hours before trying to reconnect.

This requirement is controlled by the individual financial institutions that you have chosen to aggregated into MoneyMap. Depending on the financial institution's security requirements, they may prompt you to validate your information each time you login in order to aggregate your account details.

After aggregating an account, follow these steps to reassign it to a different account type:

- Click on the account name

- Click the ellipses icon in the right corner and select "Edit Details"

- Then select the appropriate account type (Property, Mortgage, Investment, etc)

- Then click Save

Have more questions?

Or contact us at (808) 643-4343 or toll-free at (888) 643-4343.