Digital Banking FAQs

General

Go to our Support section for detailed instructions on how to Update Your Username or Password.

If you forgot your password, you can reset your password online by clicking on the "Forgot Your Password?" link at fhb.com or using the FHB Mobile app. We will ask you to verify your identity via security code or by answering your security questions.

If you forgot your username, you can use the "Forgot Your Username" link at fhb.com or on the FHB Mobile app, to recover your username. A link will be sent to your email address on file and you will be sent a security code via text or phone call to verify your identity. Once verified, your username will be displayed.

If you have already tried this and still need assistance, call 643-4343 (1-888-643-4343 from the Continental U.S., Guam, and CNMI). Too many failed login attempts will lock you out of your online banking account.

Once logged in to FHB Online, go to "Settings" then click "Profile". There you can update your email address and phone number. If you would like to change the address on any of your accounts, please Send a Secure Message in FHB Online by clicking the "Messages" link. Select "Change of Address" from the subject line drop down menu, then include your new address and each bank account that should be updated with the new address.

Go to our Alerts & Notification page for detailed instructions on how to Create and Manage Your Alerts

The current balance is the total amount of funds in your account. The available balance is your current balance less any outstanding holds or debits that have not yet posted to your account.

With Online Banking you will be able to view 45 days of history for your deposit accounts; however, credit card accounts will show only history from the day you enrolled. As transactions post to your account, you can view them going forward. You will eventually be able to see as much as 36 months of past activity and 7 years of eStatements on your accounts. The amount of account activity information may vary when accessing the information via Quicken/QuickBooks. The FHB Mobile app displays up to 90 days of transaction history.

If you need immediate attention, such as technical issues, stopping a payment on a Paper Check, reporting a lost or stolen card, or reporting an unauthorized transaction from one of your Accounts, call us at 844-4444 (or 1-888-844-4444 from the Continental U.S., Guam, and CNMI). For all other inquiries, please contact us through the Message section of your FHB Online service and we will respond within a few business days.

To enable fingerprint or facial login, please follow this guide in our Support section.

The FHB Mobile app offers facial or fingerprint authentication on supported iPhone®, iPad® and AndroidTM devices. All registered fingerprints and face IDs on the mobile device will be able to login.

The FHB Mobile app is available for many smartphones and tablets including iPhone, iPad, and Android devices. For mobile deposit, auto-focus must be supported on your device. Please see below for a list of the operating systems that are supported for the FHB Mobile app.

- Android running Marshmallow (6.0) and newer

- iOS devices running iOS 13 or newer

- iPadOS devices running 13.1 or newer

If you confirmed you are using a supported operating system and continue to experience issues with the mobile app please contact customer service at (808) 643-4343 or toll-free at (888) 643-4343.

eStatements[[SM]]

FHB Online

Click on "Statements" then select "View Statements". Select the account and the month of the statement you would like to view, then click the "View and print document" button. We also recommend that you disable any pop-up blocking software enabled on your web browser.

FHB Mobile

You must first be enrolled for eStatements in FHB Online Banking under Statements > Preferences, before you are able to view eStatements in the FHB Mobile app.

No. Online check images are provided as an additional service to assist you with your banking needs. This will not change the way you currently receive your statements.

Go to our Support section for detailed instructions on how to manage eStatements.

Yes. Each time a new statement is available, you will be sent an email notification to the email address in your Online Banking profile. Should your email address change, please update your information by going to "Settings" then "Profile".

Statements are available online from 2022 onward and will be stored for up to seven years. Paper copies of older statements can be requested by sending us a secure message with the subject “Statement Copy Request”.

Statements are generally available for viewing 48 hours after the statement cut-off date (please allow additional time for weekends and holidays). If it's within 48 hours from the statement cut-off date, please contact customer service at 888-844-4444 for assistance. Or, if you have a combined statement, like with the paper statement, all combined account information will show up on a single statement listed under the primary account number (not under each individual account number).

Please note that for credit cards, you may not have a statement if your balance is zero and there were no transactions during the billing period.

Zelle[[®]]

Zelle[[®]] is a fast, safe and easy way to send money directly between almost any bank accounts in the U.S., typically within minutes[[#1]]. With just an email address or U.S. mobile phone number, you can send money to people you trust, regardless of where they bank[[#2]].

You can send, request, or receive money with Zelle[[®]].

- To get started, log into First Hawaiian Bank’s online banking or the FHB mobile app, navigate to “Payments” then "Send Money with Zelle[[®]]". To Enroll, accept the terms and conditions, provide your email address or U.S. mobile number and deposit account, and then you will receive a one-time verification code, enter it, and you're ready to start sending and receiving with Zelle[[®]].

- To send money using Zelle[[®]], simply add a trusted recipient's email address or U.S. mobile phone number, enter the amount you'd like to send and an optional note, review, then hit "Send." In most cases, the money is available to your recipient within minutes[[#1]].

- To request money using Zelle[[®]], choose "Request," select the individual(s) from whom you'd like to request money, enter the amount you'd like to request, include an optional note, review and hit "Request"[[#3]].

- To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle[[®]].

If you have already enrolled with Zelle[[®]], you do not need to take any further action. The money will be sent directly to your bank account and will be available typically within minutes[[#1]].

If you have not yet enrolled with Zelle[[®]], follow these steps:

- Click on the link provided in the payment notification you received via email or text message.

- Select First Hawaiian Bank.

- Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile number where you received the payment notification - you should enroll with Zelle[[®]] using that email address or U.S. mobile number where you received the notification to ensure you receive your money.

Zelle[[®]] is a great way to send money to family, friends, and people you are familiar with such as your personal trainer, babysitter or neighbor[[#2]].

Since money is sent directly from your bank account to another person's bank account within minutes[[#1]], Zelle[[®]] should only be used to send money to friends, family and others you trust.

Neither First Hawaiian Bank nor Zelle[[®]] offers a protection program for any authorized payments made with Zelle[[®]] – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

It's easy — Zelle[[®]] is already available within First Hawaiian Bank’s online banking and mobile banking app. Download the FHB Mobile app or sign-in online and follow a few simple steps to enroll with Zelle[[®]] today.

No, First Hawaiian Bank does not charge any fees to use Zelle® in the FHB Mobile app for personal customers.

Business customers must be enrolled for FHB Online Business Banking to use Zelle® with a small business checking account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle® and Entitlements. See FHB Online Terms & Conditions for details.

Your mobile carrier’s messaging and data rates may apply.

You can find a full list of participating banks and credit unions live with Zelle[[®]] here.

If your recipient's financial institution isn't on the list, don't worry! The list of participating financial institutions is always growing, and your recipient can still use Zelle[[®]] by downloading the Zelle[[®]] app for Android and iOS.

To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number, and a Visa[[®]] or Mastercard[[®]] debit card with a U.S. based account (does not include U.S. territories). Zelle[[®]] does not accept debit cards associated with international deposit accounts or any credit cards.

When you enroll with Zelle[[®]] through your online banking account, or mobile banking app, your name, the name of your bank, and the email address or U.S. mobile number you enrolled is shared with Zelle[[®]] (no sensitive account details are shared – those stay with First Hawaiian Bank).

When someone sends money to your enrolled email address or U.S. mobile number, Zelle[[®]] looks up the email address or mobile number in its "directory" and notifies First Hawaiian Bank of the incoming payment. First Hawaiian Bank then directs the payment into your bank account, all while keeping your sensitive account details private.

In order to use Zelle[[®]], the sender and recipient's bank accounts must be based in the U.S.

You can only cancel a payment if the person you sent money to hasn't yet enrolled with Zelle[[®]]. To check whether the payment is still pending because the recipient hasn't yet enrolled, you can go to your activity page, choose the payment you want to cancel, and then select "Cancel This Payment."

If the person you sent money to has already enrolled with Zelle[[®]], the money is sent directly to their bank account and cannot be canceled. This is why it's important to only send money to people you trust, and always ensure you've used the correct email address or U.S. mobile number when sending money.

If you sent money to the wrong person, we recommend contacting the recipient and requesting the money back. If you aren't able to get your money back, please call customer service at (888) 643-4343 so we can help you.

Scheduled or recurring payments sent directly to your recipient’s account number (instead of an email address or mobile number) are made available by First Hawaiian Bank but are a separate service from Zelle® and can take 1 – 3 business days to process.

You can cancel a payment that is scheduled in advance if the money has not already been deducted from your account.

Money sent with Zelle[[®]] is typically available to an enrolled recipient within minutes[[#1]].

If you send money to someone who isn't enrolled with Zelle[[®]], they will receive a notification prompting them to enroll. After enrollment, the money will be available in your recipient's account, typically within minutes[[#1]].

If your payment is pending, we recommend confirming that the person you sent money to has enrolled with Zelle[[®]] and that you entered the correct email address or U.S. mobile phone number.

If you're waiting to receive money, you should check to see if you've received a payment notification via email or text message. If you haven't received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or U.S. mobile phone number.

Still having trouble? Please contact customer services at (888) 643-4343.

Yes! They will receive a notification via email or text message.

Keeping your money and information safe is a top priority for First Hawaiian Bank. When you use Zelle[[®]] within our mobile app or online banking, your information is protected with the same technology we use to keep your bank account safe.

If you don't know the person or aren't sure you will get what you paid for (for example, items bought from an online bidding or sales site), you should not use Zelle[[®]] for these types of transactions.

These transactions are potentially high risk (just like sending cash to a person you don't know is high risk). Neither First Hawaiian Bank nor Zelle[[®]] offers a protection program for any authorized payments made with Zelle[[®]] – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

Your email address or U.S. mobile phone number may already be enrolled with Zelle[[®]] at another bank or credit union. Call our customer service team at (888) 643-4343 and ask them to move your email address or U.S. mobile phone number to First Hawaiian Bank so you can use it for Zelle[[®]].

Once customer support moves your email address or U.S. mobile phone number, it will be connected to your First Hawaiian Bank account so you can start sending and receiving money with Zelle[[®]] through the First Hawaiian Bank mobile banking app and online banking. Please call First Hawaiian Bank’s customer support toll-free at (888) 643-4343 for help.

Small Businesses using Zelle[[®]]

Zelle[[®]] is a fast and easy way for small businesses to send, request, and receive money directly between eligible bank accounts in the U.S.[[#4]] If your customers use Zelle[[®]] within their mobile banking app, they can send payments directly to your First Hawaiian Bank checking account with just your email address or U.S. mobile number. With Zelle® payments typically arrive within minutes[[#1]] .

You can send, request, or receive money with Zelle[[®]]. To get started log into FHB Online Banking or the FHB Mobile app, go to “Payments” and select “Send Money with Zelle[[®]]”. Enter your email address or U.S. mobile number, receive a one-time verification code, enter it, accept terms and conditions, and you’re ready to start sending and receiving with Zelle[[®]].

When you use Zelle[[®]] with a business checking account, you can send money to other small businesses with an eligible account at a financial institution that offers Zelle[[®]] to small businesses. You can also send money to consumers that have access to Zelle[[®]] through their mobile banking app. At this time, we don’t support sending to (or receiving from) consumers that are only enrolled in the Zelle[[®]] app[[#5]].

If the small business or consumer you send money to has already enrolled with Zelle[[®]] through their bank’s mobile app, the money is sent directly to their bank account and the transaction cannot be canceled. It’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

You can receive payments from consumers using Zelle[[®]] through their bank’s mobile app. You can also receive payments from other small businesses if their financial institution offers Zelle[[®]] to small businesses. At this time, you’re not able to receive payments from consumers that are only enrolled in the Zelle[[®]] app[[#5]].

Once you’re enrolled with Zelle[[®]] the money you receive is typically available within minutes.

First, you should enroll your email address or U.S. mobile number with Zelle[[®]] through your mobile banking app and associate it with your business checking account. Second, share your enrolled email address or U.S. mobile number with your customers and ask them to send you payment with Zelle[[®]] right from their banking app. You don’t need to share any sensitive account details; they can send you money by using your enrolled email address or U.S. mobile number to identify you. After the consumer sends you payment with Zelle[[®]], you will receive your money directly into your enrolled checking account.

You can also request payments directly through the FHB Mobile app by clicking on “Payments” then “Send Money with Zelle[[®]]”. Select “Request,” entering your customer’s email address or U.S. mobile number, confirming the recipient is correct (make sure you’ve entered the correct email address or U.S. mobile number of the person or business you want to request payment from) and tapping “request”.

If your customer is using Zelle[[®]] through their bank’s mobile app, they’ll be able to pay you with Zelle[[®]]. You’ll receive a payment notification once your customer has sent you money in response to your request. If your customer is enrolled in the Zelle® app[[#5]], they will not be able to send you money with Zelle[[®]], and you should arrange for a different payment method.

There are a few ways you can encourage your customers to pay you with Zelle[[®]].

- Tell customers verbally that you accept payments with Zelle[[®]] and that they can easily send you money right from their banking app.

- Include it on an invoice. We recommend adding “I accept payments with Zelle[[®]]” or “Pay me with Zelle[[®]]”.

- Use Zelle[[®]] to request money[[#3]] from your customers (which will send them a notification telling them you’ve requested payment with Zelle[[®]]).

- Add pre-approved Zelle[[®]] content to your business website:

zellepay.com/smallbusiness-toolkit.

Please note, you’ll only be able to receive payments from consumers using Zelle[[®]] through their financial institution’s mobile banking app. You will not be able to receive payments from consumers enrolled in the Zelle[[®]] app.

To request money with Zelle[[®]], login to FHB Online or the FHB Mobile app and go to “Payments” then select “Send Money with Zelle[[®]]”. Choose “Request,” select the individual from whom you’d like to request money, enter the amount you’d like to request, include an optional note, review and hit “Request”.[[#3]]

Neither First Hawaiian Bank nor Zelle[[®]] offers a protection program for any authorized payments made with Zelle[[®]] – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

You must be enrolled for FHB Online Business Banking to use Zelle[[®]] with a small business account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle[[®]] and Entitlements. See FHB Online Terms & Conditions for details.

Whether you use Zelle[[®]] with a business account or a consumer account, Zelle[[®]] uses the same network to initiate payments to small businesses and consumers. Consumers who are already enrolled with Zelle[[®]] through their mobile banking app don’t need to do anything different to send money to a small business – they use the existing Zelle[[®]] experience they already know and trust within their bank’s mobile app. However, the experience is slightly different for small businesses[[#4]], as small businesses cannot currently send payments to or receive payments from consumers who are only enrolled in the Zelle[[®]] app.

You must be enrolled for FHB Online Business Banking to use Zelle[[®]] with a business checking account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle[[®]] and Entitlements. See FHB Online Terms & Conditions for details.

You must be enrolled for FHB Online Business Banking to use Zelle[[®]] with a business checking account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle[[®]] and Entitlements. Please review the updated terms and conditions that were provided by First Hawaiian Bank.

To get started, log into FHB Online or the FHB Mobile app. If both your personal and business accounts are available in your FHB Online profile, you can select the appropriate checking account when sending a payment.

If you have a separate login for your personal and business accounts or are enrolled with Zelle[[®]] at another financial institution, you must use a different U.S. mobile number or email address than the one you used to enroll your personal bank account with Zelle[[®]]. For example, aloha@email.com would be connected to your personal checking account, and 555-555-1234 would be connected to your small business account.

No, Zelle[[®]] does not integrate directly with accounting software at this time. However, since Zelle[[®]] is connected to your bank account, you are able to see all Zelle[[®]] transactions in your online banking transaction records. If your bank account transactions feed into accounting software, you will see the Zelle[[®]] transactions.

You must be enrolled for FHB Online Business Banking to use Zelle[[®]] with a business checking account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle[[®]] and Entitlements.

Please contact us at (888) 643-4343 for assistance.

You can only cancel a payment if the small business or consumer you sent money to hasn’t yet enrolled with Zelle[[®]]. To check whether the payment is still pending because the recipient hasn’t yet enrolled, you can go to your activity page, choose the payment you want to cancel, and then select “Cancel This Payment.”

If you send money to a small business or consumer that has already enrolled with Zelle[[®]] through their bank or credit union’s mobile app, the money is sent directly to their bank account and cannot be canceled. This is why it’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

If you try to send money to a consumer who is enrolled in the Zelle[[®]] app[[#5]], the payment won’t go through and a message will pop up to let you know the payment cannot be completed. With small business accounts, Zelle[[®]] does not currently support sending money to users enrolled in the Zelle[[®]] app.

If you sent money to the wrong person, please contact us immediately at (888) 643-4343 for assistance.

Yes, for security reasons we limit the amount of money you can send through Zelle[[®]]. You can view your daily and monthly (30-day period) Zelle[[®]] send limits by logging in to FHB Online or the FHB Mobile app. Once in Zelle[[®]], select a contact that you want to send money to then click on the question mark next to “Limits”. We may change these limits at our sole discretion.

Yes, for security reasons we limit the amount of money you can send through Zelle[[®]]. You can view your daily and monthly (30-day period) Zelle[[®]] send limits by logging in to FHB Online or the FHB Mobile app. Once in Zelle[[®]], select a contact that you want to send money to then click on the question mark next to “Limits”. We may change these limits at our sole discretion.

CheckImage[[SM]]

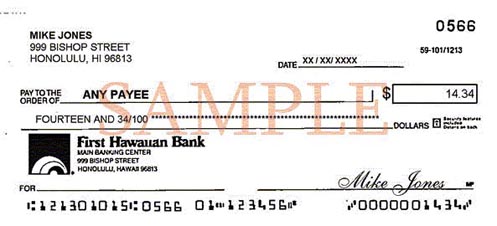

Sample of CheckImage Front

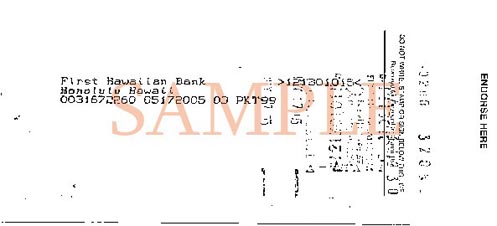

Sample of CheckImage Back

No. Online check images are provided as an additional service to assist you with your banking needs. This will not change the way you currently receive your statements.

Images of cleared checks are available in the Account Details section by clicking on the check number of the check you wish to view. You then have the option to view or print both sides of the check. Special software is not necessary to view check images online. However, we do recommend that you disable any pop-up blocking software enabled on your web browser.

CheckImage is available to all customers enrolled in FHB Online service allows you to view and print images of the front and back of checks that have cleared your Checking account. Online check images through FHB Online are usually available within one business day after the checks have cleared your account. When you enroll in FHB Online, you will automatically have the ability to view images of checks online for no additional cost.

Images of checks that you have written are available through FHB Online as long as the check transactions appear in your Account Details. Special check image requests can be requested by sending us a Secured Message through FHB Online.

Trust, Investments, and Insurance Accounts

Insurance policies don’t typically have a “balance.” Depending on the type of policy, they may have a cash value but this information is not displayed. Please contact your Account Officer if you have questions about your policy.

Although TotalWealth[[®]] and FHB Online both provide online access to wealth management account information, the available information and features are different. Please contact your Account Officer to discuss which service may best fit your needs (e.g., if you are a business customer).

Go to the enrollment page and follow the instructions to determine the best enrollment process for you.

Once enrolled, you will be able to view a list of your organization’s accounts and balances, but you will not be able to view detailed information on the accounts. If you would like access to more information, please contact your Account Officer to discuss alternatives that may be available to you. If you need assistance with identifying your account manager, please call 808-525-7027 for assistance with your Wealth Management Account.

Login & Troubleshooting

FHB Online uses several methods to protect your accounts. Techniques we use include stringent password requirements, and two-step authentication.

Passwords – Passwords must be a minimum of 9 characters and a maximum of 32 characters. We require at least one upper-case and lower-case letter and one number. Certain special characters are allowed but not required.

Secure Access Code (SAC) is a method we use to verify your identity once you have provided your login credentials. Our system will ask to send a Secure Access Code to your phone number or email address on your profile and you will need to enter this code in order to proceed.

To access your accounts and pay bills through FHB Online, you must use a browser that supports 128-bit encryption security. Additionally, certain features of FHB Online are best experienced with the latest versions of Google Chrome, Microsoft Edge, FireFox or Safari.

Once logged into FHB Online, go to “Settings” then click on "Security Preferences" and "Secure Delivery". You are able to add multiple phone numbers and email addresses that can be used to verify your identity when logging in.

Yes. You can access FHB Online from any computer. Remember to always logout when you are done using the service and never to share your username or password with anyone.

We recommend you download the FHB Mobile app before your departure. Once you login to the mobile app it will verify your identity by sending a Secure Access Code.

MoneyMap

Yes, the majority of FHB Online MoneyMap features are available through the FHB Mobile app, with the exception Goals, Trends and Cash Flow. Those features are exclusively available through FHB Online. FHB Mobile also offers Insights which provides personalized insights on your transactions to call out unusual activity such as duplicate payments, a new subscription, high than normal spending in a category and much more.

Yes, once in MoneyMap click on the Transactions tab. Then on the “Export CSV” option toward the right of the screen.

If you recently deleted the account from MoneyMap and are trying to reconnect it, we suggest waiting at least a few hours before trying to reconnect.

This requirement is controlled by the individual financial institutions that you have chosen to aggregated into MoneyMap. Depending on the financial institution's security requirements, they may prompt you to validate your information each time you login in order to aggregate your account details.

After aggregating an account, follow these steps to reassign it to a different account type:

- Click on the account name

- Click the ellipses icon in the right corner and select "Edit Details"

- Then select the appropriate account type (Property, Mortgage, Investment, etc)

- Then click Save

Small Business Entitlements

Yes, if their user profile is enabled to use Direct Connect. For detailed information on how to setup user access view our Entitlements User Guide.

No. We recommend that primary users review their list of active sub-users throughout the year to ensure the information is up to date.

Login to FHB Online and click on "Settings" then "Manage Users". Click the pencil icon next to the user's name then click the "Delete" button. Once a user has been deleted, it cannot be undone. For detailed information on how to manage user access view our Entitlements User Guide.

A user's contact information and username cannot be edited once created. For detailed information on how to manage user access view our Entitlements User Guide.

Quicken[[®]] & QuickBooks[[®]]

Yes. You can export your transaction information directly from FHB Online into Quicken or QuickBooks. See below for instructions.

Click on an account, then on the Transactions tab click the "Export" icon. A dropdown menu will appear with the option to download your transactions to a Quicken (qfx) or QuickBooks (qbo) file.

Balance and transaction information downloaded through Quicken and QuickBooks is current as of the previous business day. Current balance and transaction information are available on FHB Online.

Mobile Deposit

You may view the status of your mobile deposit and images of mobile deposited checks for up to 30 days by clicking on “View activity” tab after clicking the "Deposits" button in the mobile app. Pending deposits will appear grayed out at the top of the screen. Successfully submitted deposits will say “Accepted” and the deposit will appear in your once fully processed. If a mobile deposit is placed on hold or rejected for any reason, you will be notified via email.

Mobile deposits may also be viewed by logging into FHB Online Banking using a browser. After logging in, click on "Transfers & Deposits", then "Transfer & Deposit Activity", and finally "Mobile Deposits."

Upon successful posting to your account, your deposit will be reflected as "MBDEPOSIT" on your account statement and in FHB Online.

After depositing your check using Mobile Deposit, securely store your check until you have confirmed your funds have been deposited. This allows sufficient time in case the original check is required for any reason. If we send you a notice that your deposit could not be processed, you may visit any of our branches for further information about how you might be able to deposit the check.

If we are not able to process your deposit or need to make a correction, we’ll send an email notice to the email address we have on our files. You may view the status of your mobile deposit and images of mobile deposited checks for up to 30 days by clicking on “View activity” tab after clicking the "Deposits" button in the mobile app. However, the status information provided by the app is for your convenience only and is subject to change.

Funds are generally available the first business day after receipt but, in some circumstances, may be held pursuant to our check hold policy. You may view the status of your mobile deposit and images of mobile deposited checks for up to 30 days by clicking on “View activity” tab after clicking the "Deposits" button in the mobile app. However, the status information provided by the app is for your convenience only and is subject to change.

The cut-off time for submitting checks is 5:00 p.m. Hawaii Standard Time each Business Day. Checks submitted after 5:00 p.m. Hawaii Standard Time or on weekends or holidays will be processed as if they were submitted on the next Business Day. A Business Day is every calendar day except for Saturdays, Sundays and bank holidays.

Please refer to our FHB Mobile Banking Terms and Conditions to learn more about eligible and ineligible checks for Mobile Deposit.

Online Bill Pay

Log in to FHB Online® and click on the "Settings" link. Click on the "Unenroll from Bill Pay" link. Please confirm that you have no scheduled bill payments. You will need to cancel any scheduled and pending payments prior to unenrolling, to ensure they are not processed.

Yes, up to your overdraft protection limit (Yes-Check®).

You can schedule a payment up to one year in advance.

You can schedule as many payments as you need. The Online Bill Payment monthly service fee is a flat fee. There is no per-transaction fee for payments.

The maximum amount of any one payment is $99,999.99.

The confirmation number is a record of your transaction request. It is useful to identify a transaction with this number when making inquiries on a specific bill payment or funds transfer.

The cut off time for standard payments may be as late as 10:00 pm ET depending on your payee’s arrangement with our processor, however we may begin processing your payment prior to the cutoff time.

For expedited payments, the cut off time for same-day electronic payments is 10 PM ET and the cut off time for overnight paper checks is 4 pm ET. Once scheduled, expedited payments will begin processing immediately.

Cut off times may vary based upon your payees processing capabilities. Please review the payment status to determine if a payment can be modified or canceled. In process payments cannot be canceled in the Payment Center.

Pending payments are payments you have scheduled through the Online Payment service, which have not yet been processed and sent to the payee.

We maintain relationships with thousands of companies, and manage their contact info for you. We don’t have to ask you for the contact info for these companies because we already have it. If the address changes, these companies contact us directly.

Your account number is the most reliable way to ensure that the company can credit your payments properly. If your account info is not correct, your payment may be credited late or not at all. Late fees, finance charges, or service disconnections may result. The Service Guarantee applies to payments only if all the info you provided is accurate.

Sometimes companies use repeated characters (such as ***, ###, or xxx) to hide part of your account number on statements or bills. Be sure to enter your full account number instead of the characters used to hide your account number. We need the full account number to ensure that your payment is credited properly.

Some small companies, such as landscaping or cleaning services for example, may not assign you an account number. If you don't have an account number, you can enter other info that identifies you to the company you are paying. For example, you can use your service address or the name on the account.

Go to the Payee List on the Payment Center and select the Payee name you wish to modify or delete.

If an automatic payment is scheduled for delivery on a non-business day such as a weekend or holiday, the date is adjusted to the preceding business day.

The Pending Payments section in Payment Center will show the adjusted delivery date. You can change the date as needed.

Fiserv is our online payment processor. You may receive communications from Fiserv if there are issues with payments from your account.

If you want to stop any payment that has already begun processing, you must contact our Online Banking Customer Service. Although FHB will make every effort to accommodate your request, FHB will have no liability for failing to do so. The success of the stop payment request will depend on the status of the payment at the time of the request. A stop payment request may incur additional fees. See FHB Online Terms and Conditions for details.

You can see the status of your payments in Activity. Payments start in a Pending status until processing begins.

You must cancel and reschedule an AutoPay payment when you update the address for the payee. If you don't cancel and reschedule the payment, the payment will continue to go to the address that was on file for the payee at the time the AutoPay payment was originally set up.

You may cancel or edit any Scheduled Payment (including recurring payments) by following the directions within Online Bill Pay. Once the Service has begun processing a payment it cannot be cancelled or edited. If you want to change only the next occurrence of an automatic payment, locate the payment in the Pending Payments section of Payment Center. Select the payment, and then click Change or Cancel.

Yes. AutoPay allows you to set up repeating payments in FHB Online Bill Payment. You can set up AutoPay for any company or person you pay regularly.

Quick Facts

- Set up and manage AutoPay and Reminders from the Payment Center.

- You can set up payments to be made based on a schedule that you set.

- You can set up some eBills to be paid automatically according to options you set.

- You can change or stop AutoPay at any time.

You are responsible for any payment you make through our Online Bill Payment. Insufficient funds may lead to additional fees and suspension or termination of service. If we send a payment on your behalf and you do not have sufficient funds when we attempt to debit your account, the following will occur:

1. Your payment will still be sent.

2. Our payment processor will notify you by email of the insufficient funds, giving you 1 day to make additional funds available to your payment account.

3. On the next day we will attempt to debit your account again. If you still do not have sufficient funds to cover the payment, we will attempt to reverse the payment from your payee.

- If the payment is reversible, our payment processor will notify you by email that the payment was reversed.

- If the payment is not reversible, our payment processor will send you a second email to notify you of the insufficient funds. You will have 5 days to resolve the balance directly with our payment processor.

4. If after 5 days, you have not resolved your balance, we will freeze your Online Bill Payment access and notify you by email. You then have 30 days to resolve your balance directly with our payment processor.

5. If after 30 days you have not resolved your balance, you will receive a final email notice that your account will go into collections if you do not resolve your balance in 20 days.

6. If after 20 days, you have not resolved you balance, we will cancel your Online Bill Payment service and submit your account for debt collection and notify you by email.

Based on your previous payment history and your payee’s outstanding payments, we may send a laser draft check to your payee. A laser draft check is a check drawn on your account, similar to a personal check. If you have insufficient funds at the time the check is deposited, the process will be the same as a bounced personal check.

Payment Reminders are useful when you want help remembering to make payments on time, but you aren’t ready to set up AutoPay. Set up and manage reminders from the Payment Center.

Your reminder is cleared when you pay, dismiss, or file a bill. When you dismiss a reminder, it's removed from the Reminders list, but it will appear again. To permanently stop reminders, select the company or person on the Payment Center, click Reminders, and stop the reminders.

If the payment is sent electronically, the money is withdrawn from your account one business day after processing begins. If the company or person cannot receive electronic payments, we print a check and mail it to the address you provide.

For some checks, the money is withdrawn one business day after processing begins. For others, the money is withdrawn when the company or person deposits or cashes the check.

The "payment date" is your payment due date excluding any grace period. This is the date when your payment is due to arrive to your payee. The "send date" or "process date" is the date we will begin processing the payment to be made to your payee. We calculate the send date based on the payment date you give us and the minimum required lead time for your payee.

Activity and Payment Details provide a detailed status of your payment.

To help you schedule enough lead time for your payment to reach your payee, the date selector will display the earliest delivery date available for standard and expedited (if available) payments. Two to five Business Days of lead time is recommended for standard payments, depending on the payment method. A Business Day is every calendar day except for Saturdays, Sundays and bank holidays.

For payees located in U.S. territories such as Guam or CNMI, please allow additional lead time for local mail service delays.

For Guam and CNMI residents, please note that the Payment Calendar reflects Continental U.S. dates and times when scheduling your payment delivery date.

Payment history information is available in Activity for 24 months.

Sometimes a payee may not credit your account immediately after they receive a payment. If the payment is not credited after two days, call the payee’s customer service line. If the problem isn’t resolved, you can send us a payment inquiry on payments in Activity. We will contact the payee on your behalf in an attempt to resolve the problem.

You may receive Bill Payment notifications via the Payment Center Messages tab; otherwise, please use the FHB Online Message Center for Online Banking Customer Support inquiries.

Expedited payments allow you to send money to your payees even faster. The payment date selector will indicate the earliest date available for delivery to your payee.

Same-day electronic payments allow you to make same-day electronic payments to applicable payees. If your payee is unable to receive electronic payments, we may be able to send an overnight paper check. The cut off time for overnight paper checks is 4:00 pm ET. Overnight delivery is only available for payees located in the Contiguous U.S.

Additional fees may apply for expedited payments. Fees incurred for an expedited payment will be drawn from your funding account, the account you are sending the payment from. Fees for expedited payments are displayed in the Payment Center. See FHB Online Terms and Conditions for details.

eBills

If your normal billing cycle has passed and you still have not received your eBill, contact the company who bills you. Depending on billing cycles, the exact day you receive your bill each month may vary. Also remember that more than a month may pass before you receive your first eBill from a company.

If you have questions about an eBill, please contact the company directly. All the info on the eBill comes directly from the company who sent it. When you pay the eBill, you can enter an amount that is different from the amount due on the bill.

Yes, you can pay an eBill by some other means, such as by check or directly on the company’s Web site if available.

However, when you pay an eBill outside of FHB Online Bill Payment, the status of the eBill remains Unpaid and it continues to appear in the Reminders section until you dismiss the reminder. To change the status, you can file the eBill and add a note about its resolution.

You can stop receiving eBills in FHB Online Bill Payment any time after the company processes your request to receive them. Select the company from the Payment Center, open Bills, and choose the option to stop eBills.

An entire billing cycle may pass before your paper bills resume.

Some companies don't offer the AutoPay scheduling options based on your eBill. However, you can always set up a recurring payment for the same amount at regular intervals.

To turn off an eBill go to the Payment Center and click on the "Bills" link for the eBill you would like to turn off. Then click on the "Cancel eBills" option and confirm cancellation. When you discontinue your eBill service, you will start receiving your bills directly from the company again.

Notes About Stopping eBills:

- You may receive one or more eBills after your request before the company stops sending them.

- It can take an entire billing cycle before your paper bills resume.

- When you stop receiving eBills, any automatic payments that you set up to pay them are also canceled.

You can still pay your bills using FHB Online Bill Pay but you will not be able to access your bill directly through the Payment Center.

Go to Activity. You can view paid eBills when you view the details of your payments.

Internal Transfers

The maximum amount that can be transferred is either the current available deposit or credit balance in your account (plus any available credit in an associated Yes-Check line of credit).

Future-dated transfers are single transfers that can be scheduled up to one year in advance.

Recurring transfers are transfers between accounts that are for the same amount or between the same accounts at specified intervals, e.g., weekly, every 2 weeks, quarterly, etc. For example, if wish to transfer $500 from a checking account to a savings account on the 3rd day of each month, you can set up an automatic recurring transfer to be made on the 3rd day of each month for as long as you wish, up to 999 times. Recurring transfers eliminate the need manually schedule identical repeating transactions.

Internal transfers requested for the current business day will be processed the same day if scheduled before the cut-off time—10pm Local Time--and the next business day if scheduled after. Local Time for a given account is the time at the location where the account was opened—i.e., HST for account opened in Hawaii, and ChST for accounts opened in Guam or Saipan. For all mortgages, credit cards and accounts opened online, Local Time is HST. Transfers from/to deposit accounts and loan accounts made before the cut-off time will appear online immediately; transfers to credit card and mortgage accounts will be effective the day they are made but will appear the following business day. Funds transfers requested for a future date (up to one year in advance) will be processed on the morning of the requested date (or next Business day if the request date falls on a weekend or Bank Holiday).

External Transfers

You may add up to a total of 10 external accounts. Please note, you will be required to go through an authentication process for each of those accounts that you own.

If, on the "send date,” the balance in your account is insufficient to make an External Transfer you authorized, we will delay the transfer and try again on the next Business Day. If there is still an insufficient balance to make the transfer, we may either refuse to pay the item, or we may make the transfer and overdraw your checking account. In either event, you will be responsible for any non-sufficient funds ("NSF") or overdraft charges we may impose.

The External Transfer debit request is initiated on the "send date" but may not post against your account for up to two Business Days.

The cut-off time for submitting External Transfers is 7:00 p.m. Hawaii Standard Time each Business Day. External Transfers submitted after 7:00 p.m. Hawaii Standard Time or on weekends or holidays will be processed the next Business Day. Any updates to an existing transfer must be made before the cut-off time on the scheduled transfer date. A Business Day is every calendar day except for Saturdays, Sundays and bank holidays.

External Transfers will be processed on the date you specify and the expected delivery date is displayed as you are creating the transfer. Transfers can also be scheduled up to a year in advance. External Transfers scheduled to process on a weekend or holiday will be processed the previous Business Day.

You can schedule an External Transfer up to one year in advance.

Yes, External Transfers may be scheduled up to 365 days in advance of the date the transfer is to be made (called a "Single External Transfer"). Automatic Recurring External Transfers may also be scheduled for substantially at regular intervals (e.g., weekly, monthly, annually) in the same amount between the same two accounts (called a "Recurring External Transfer").

The maximum daily amount allowed for external transfers is either the current available balance in the source account (plus any available credit in an associated Yes-CheckSM line of credit) or based on the chart below, whichever is less. This includes any single transfer or the total amount outstanding or "in process". For additional information, see below:

|

Inbound External Transfers |

Maximum Amount |

|

Daily |

$10,000.00 |

|

Monthly |

$20,000.00 |

|

Outbound External Transfers |

Maximum Amount |

|

Daily |

$5,000.00 |

|

Monthly |

$10,000.00 |

No, you can only transfer funds to accounts within the U.S.

You may disable External Transfers by logging into FHB Online, clicking on the "External Transfers (Personal Only)" link, and then clicking on the 'Edit Your Profile' link. Please note that you must cancel any pending transactions prior to disabling External Transfers.

Yes, you can transfer funds from your account at another financial institution to pay your First Hawaiian Bank mortgage loan, credit card, installment loan, or line of credit. The payment date will reflect the date that the External Transfer request was submitted, as long as it is complete before the 7pm HST (business days) cut-off time. Any requests made after this time will reflect the next business day’s date.

Have more questions?

Or contact us at (808) 643-4343 or toll-free at (888) 643-4343.