FHB Online Business Enrollment Form

FHB Online Business Enrollment Form

Thank you for your interest in enrolling for FHB Online Business

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. Government The browser you are using is no longer supported.

We recommend using an alternative web browser (Google Chrome,

Mozilla Firefox, Safari, or Microsoft Edge) for the best experience.

Thank you for your interest in enrolling for FHB Online Business

Request to Apply for Forgiveness of PPP Loan

Please complete the form below to let us know that you are ready to apply for forgiveness of your Paycheck Protection Program (PPP) loan.

Tip: Your SBA Loan Number and the Loan Amount may be found at the top of the first page of the Promissory Note for your PPP loan.

Important:

* Indicates a required field.

If you are being considered for a position, a Human Resource Representative will contact you within two weeks of submitting your application using the contact preference you designated when applying.

Recruiters may see all versions of your applications, profiles, and resumes when searching the database however only the best match is returned in search results.

FHB Recruiters search the job seeker database on a regular basis. However, it's best to apply for the jobs that interest you.

To facilitate the application process for job applicants with disabilities, FHB has established a dedicated email address for accommodation requests. These requests may be submitted in email to accessiblecareers@fhb.com. In your message, make sure to include your full name, the position(s) in which you are interested, and the best time and method for reaching you. Please do not include any medical or other private information in your message - our HR team will contact you within two business days.

1) log in to the system using the email address and password you provided; 2) select the position you wish to apply for; 3) click on the Add to My Jobs button; 4) review the application for completeness and accuracy; and 5) eSign, date and click the Submit button.

Yes. You can submit an application for any position(s) for which you believe you are qualified. Please submit an application for each position.

You may attach your resume during the application process.

Estate Planning is the process of preparing a strategy for transferring your assets at death. This includes your home, personal possessions, bank accounts, stocks, bonds, business, and other financial interests.

Estate Planning can be a very complex job, and is not something to be taken lightly. First Hawaiian Bank can work with you and your attorney to help you plan your legacy.

For more information, call us at 525-7134 or toll-free at 1-888-287-0398. You can also visit any conveniently located First Hawaiian Bank branch and ask for a Wealth Advisor.

Having a will is good, but it's just the beginning of Estate Planning. You must, first and foremost, consider your goals as they pertain to your family and estate. For some people, you must also include smart tax planning, because estate taxes can significantly diminish the wealth you want to leave to your family. Keeping estate taxes as low as possible means more wealth to your family.

A legal arrangement in which an individual (the Trustor) gives fiduciary control of property to a person or institution (the trustee) for the benefit of beneficiaries.

A trustee is an individual or organization which holds or manages and invests assets for the benefit of another. The trustee is legally obliged to make all trust-related decisions with the beneficiary’s interests in mind. Trustees may be entitled to a payment for their services

A fiduciary is an individual, corporation or agent holding assets for another party, often with the legal authority and duty to make decisions regarding financial matters on behalf of the other party.

As you near the age of retirement, you may begin to wonder if you will have enough money to retire comfortably and will have the means to maintain your standard of living. The best way to assure this is to prepare ahead with a solid Financial Plan.

There are three common sources of retirement income that most people count on: Social Security, a company pension plan, and personal savings.

Whether you intend to invest for long-term financial independence, retirement, your children’s college education or to build a nest egg for unexpected emergencies, our experienced professionals can assist you in developing investment strategies that help you work toward your personal and financial goals.

Our team of investment professionals, insurance specialists, private bankers, trust officers and wealth advisors combine their extensive knowledge and resources to create a portfolio that reflects your specific objectives, risk tolerance and time horizon. It’s a process that includes thoughtful and objective manager selection, rigorous oversight and regular review and evaluation of results with our clients.

First Hawaiian Bank offers strategies to help you make investment decisions in:

Our experienced professionals offer personal assistance to help you select the types of insurance that are best suited for your personal, business and estate planning needs at the most competitive price.

Benefits of working with First Hawaiian Bank:

First Hawaiian Bank's many insurance programs are designed to provide you with a solid financial future and peace of mind by giving you the protection you need in the event of death, disability, or a condition that requires long-term care. For the individual, insurance augments a comprehensive financial plan. For businesses, insurance enhances employee compensation programs and protects the business in the event of a principal’s untimely passing.

| For Individuals: | For Businesses: |

|---|---|

|

|

It's best to start with your monthly and yearly family budget. See how much income you currently need to provide you and your family with the type of lifestyle you've chosen.

Next, determine how much coverage you already have as a result of your employment or through a government program. You can ask your employer for details. You may also want to include any savings you have that can be used in such emergencies.

If these benefits approach the amount of income you require to maintain your current standard of living, then you probably have enough coverage. However, if the total amount of benefits plus your own personal resources fail to meet your income needs, you should consider additional disability insurance.

Disability insurance is especially important if you are self-employed or are a small business owner, since many business owners are crucial to their company's day-to-day success.

There are a number of factors that make up insurance policies. You need to know what these areas are and what kind of coverage is necessary for you and your family.

Sources of disability income stem from three main areas:

Disability Insurance is designed to replace wages lost due to sickness or injury, and is the best way to protect against financial catastrophe. Proper health insurance should cover the majority of your medical costs, but it won't replace lost income.

As long as you're a homeowner under age 65, you're eligible to apply. Once your coverage is approved, your premium will be automatically billed and collected with your monthly mortgage payment, so there's no extra bill to bother with each month.

There's absolutely no risk in applying for the mortgage life insurance plan. You may cancel your coverage at any time. Once you've been approved for coverage, a policy or certificate of insurance will be sent to you with the coverage details. You'll have 30 days to look it over. If you decide this coverage isn't for you, simply return the policy or certificate to us and your coverage will be canceled. If any premiums were paid in that time, they will be promptly returned.

Many households rely on two incomes to make ends meet. Mortgage life insurance provides a way to insure against the loss of a working spouse or co-borrower at a premium that is half the cost of the premium rate of the oldest of the co-borrowers.

Mortgage Life pays a benefit for any cause of death, with the exception of suicide committed during the first two years of coverage.

This plan offers you an affordable way to make sure the benefits will be used to pay off your mortgage. Mortgage life insurance takes care of your outstanding mortgage loan so that your other insurance policies, if available, can be used to cover expenses like monthly bills, a college education or retirement.

Mortgage Life Insurance ensures that your loved ones will continue to have a place called home in the event that you’re no longer there to care for them. The Mortgage Life Insurance plan is designed to pay off the outstanding mortgage balance on your home if you die during the term of the loan.

With long-term care insurance, you can rest easy. Your policy can't be canceled (except for nonpayment of premiums), and your premium cost can remain level throughout the years. But most importantly:

There are many different kinds of policies available. And costs can vary among policies, and among insurance companies offering the same type of coverage. For the best peace of mind, look for these features in a long-term care policy:

Long-term care insurance is not a one-size-fits-all arrangement. You can decide which coverage you need - and where you'll need it - based on your family situation. You can structure a plan that covers any or all of these types of care: Nursing Home and Assisted Living, Home Care, Professional Home and Community Care, or Total Home Care.What's more, your coverage doesn't have to be all-or-nothing. Your benefits can kick in when you require substantial assistance with as little as two out of the six activities of daily living (ADLs).

Long term care insurance can provide the assistance you might need in the event of a prolonged illness or disability, while relieving your family from financial and emotional burdens.

In a nutshell, it is a protection plan that pays you a set amount when you can no longer live independently. It can help pay your nursing home costs, your assisted living costs - even your costs when you are disabled and confined to your home. Whenever you can't perform some of the essential activities of daily living (ADLs) - eating, bathing, getting out of bed, going to the bathroom, walking, dressing yourself, etc. - your long-term care insurance will cover the cost of caring for you.

It pays no matter what your age: a 30-year old with a permanent spinal injury, or an 85-year old unable to perform simple daily functions such as eating or dressing.

Long-term care insurance gives you peace of mind. And it protects your investments and your estate you've worked so hard to accumulate.

As people live longer, long-term care insurance is more important than ever. Under federal law enacted in 1996, premiums may be tax deductible and benefits tax free if you own a tax qualified long term care policy.

There are many types of long-term care policies available with a variety of options and features. We survey the market to offer our customers only the best products from the highest rated companies in the industry. If for some reason the plans we offer don’t quite suit your needs, we’ll shop outside for the best plan for you. That’s First Hawaiian Bank’s commitment to you as our valued customer.

The amount of life insurance will vary depending on your personal and family situation. In general, life insurance needs are created whenever you have a change in life events such as marriage, starting a family or business, or retirement. To determine how much life insurance you need, use this simple test to help you develop a solid foundation for your financial plan.

Financial experts agree that the foundation of any good financial plan includes life insurance. A well-designed life insurance program can improve and enhance your retirement, estate planning and family protection plans.

The amount, type of insurance and the duration of your life insurance policy will depend on your family situation, your financial goals and your health.

An individual life insurance policy is normally purchased to accomplish the following goals:

There are several options to make a payment to your loan:

Please contact us at [[(808) 943-4525 | tel:808-943-4525]] to request a payoff quote.

A personal loan is an installment loan product with a fixed term. When your application is approved, the full loan amount you are approved for is disbursed to you at once, and you begin accruing interest on the outstanding amount immediately from that day. Because FHB's personal loans all offer fixed rates over the life of the loan, your monthly payments are the same throughout the loan term.

In contrast, a Personal FirstLine (PFL) is a revolving line that can be drawn on at any time up to your available credit limit. You can draw on your PFL by making a transfer within FHB Online, writing a check, or by requesting a withdrawal in person at an FHB branch. As you repay the outstanding principal (the amount you have drawn from your line), your available credit will increase by the amount you have repaid. Consequently, your monthly payment will vary if your outstanding balance and/or the rate changes.

You may apply online or by visiting any FHB branch.

You will need documents and information to apply:

After submitting your application, FHB may follow up to verify your information

It is a line of credit secured by your home or other improved property you own. Depending on the equity in the property, and other factors, your credit line can range from $20,000 to $1,500,000.

A Home Equity Line of Credit has a Draw Period and a Repayment Period. During the draw period you can draw on your line of credit by writing a check or advancing the funds through FHB Online. Besides an annual fee, there are no monthly payments until you draw on your line and you can even make interest-only payments during the Draw Period. As you pay down the balance on your line of credit, it becomes available to use again.

During the Repayment Period, you can no longer draw on your line of credit and must repay any outstanding balances. Outstanding balances can be converted to fully-amortized, fixed-rate locks during both the Draw Period and Repayment Period.

There is a $100 annual fee assessed one year after the Draw Period begins and $100 each year thereafter. The annual fee is waived if you have a Priority Banking Platinum Checking Account. The annual fee will not be charged during the Repayment Period.

First Hawaiian Bank offers a home equity line of credit on many types of property, including:

You must have property insurance on the property you use for collateral. Only available for properties located in Hawaii and Guam.

Once you’ve opened your Home Equity Line of Credit, you’ll receive checks that look and work much like any regular personal checks. To draw on your line of credit, just write a check for the amount you need. You can also draw on your line using FHB Online. Even if you don’t need the funds now, it’s nice to know your Home Equity Line of Credit will be there when you need it.

Use it for home improvements, tuition payments, bill consolidation, buy a new car, or go on vacation. It's easy and convenient to pay for almost anything.

The lien release will be sent to the mailing address on the loan at time of payoff. If you need to change this information, you may send us a Secured Message through FHB Online using the subject, "Mortgage".

Find out about rates and more online at FHB.com or by calling Home by Phone at 808-643-4663.

Please contact us at 808-844-4178 or toll-free at 1-800-362-7606, Monday through Friday 7:30am -4:30pm HST if you are unable to make your mortgage payment.

For questions regarding existing mortgage accounts, please call Mortgage Service Center at 808-844-4178 or toll-free at 1-800-362-7606, Monday through Friday 7:30am - 4:30pm HST.

We’re here to help make the process of applying for a mortgage as simple for you as possible.

Choosing the right mortgage depends on your budget and situation. You would also have to understand the various features of your options. For a free analysis and recommendation of the best mortgage loan program for you, please call us at 808-643-HOME (4663) or take a look at our Mortgage Selector Tool. We also have mortgage calculators that can help you determine what is right for you.

The difference between a mortgage loan originator and a mortgage broker is that our mortgage loan originators are in-house and provide you with customized one-on-one service. A mortgage broker does not work for a particular bank and actually shops a list of several banks and alternative lenders to find a mortgage for his or her clients. They are not always able to provide you with other financial products. At First Hawaiian Bank, our mortgage loan originators provide information about our home financing options and will help guide you through the entire purchase process. Our mortgage specialists can also give you access to other banking experts who can help meet your other financial needs.

Your county will record the lien release (a document stating your mortgage is paid in full) after we notify and send them all applicable documents. Once we have received the recorded lien release, it’s sent to the mailing address on file. Please contact your county record’s office for a copy of the lien release.

If there is an overpayment, your refund check will be sent approximately 10 business days after the final payment is received.

Please call 808-844-4178 or toll-free 1-800-362-7606 to request a payoff quote. Please have your complete loan number and the date you expect us to receive your final payment when you call.

A payoff statement itemizes the amount required to fully satisfy all obligations secured by the loan that is the subject of the payoff request. This written statement is prepared in response to a request by a client or an authorized 3rd party. There is no charge to have a payoff statement mailed to you or an authorized third party.

Yes, multiple advance payments can be scheduled. However, when making advance payments, you must specify whether those additional payments should be applied to future monthly payments or to the principal.

There are certain situations where this option is not available. For further information, please call Mortgage Loan Servicing at 808-844-4178 or toll free at 1-800-362-7606, Monday through Friday 7:30am -4:30pm HST for details.

We will notify you by mail that your request was not processed and a $20 fee for insufficient funds will be assessed to your loan.

A payment to your mortgage loan via a credit card or credit card "convenience checks" is not allowed at this time. Please contact us at 808-844-4178 or toll-free at 1-800-362-7606, Monday through Friday 7:30am -4:30pm HST if you wish to discuss other payment options.

You may use any checking or savings account with U.S. funds to which you are an account holder and have the authority to use.

As long as your current month's mortgage payment has been posted to your loan and you have no outstanding fees, you will be able to make additional principal only payments. The most convenient option is to make your payment via the FHB Online & Mobile Banking option to Make an FHB Payment.

Payments will be applied the following business day. The date you submit the transfer will be your payment date as long as the transfer is completed prior to the transfer cutoff time. Any transfers processed after the transfer cutoff time will reflect the following business day as your payment date.

If making a payment at a branch, please let the banker know so they can process the payment accordingly.

Use it for home improvements, tuition payments, bill consolidation, buy a new car, or go on vacation. It's easy and convenient to pay for almost anything.

Consumer Home Equity Loans cannot be used to purchase the subject property.

While the Consumer Home Equity Loan and Home Equity Line of Credit (HELOC) are both secured by your real property, they have some differences. The Consumer Home Equity Loan is an installment loan with a fixed loan amount, interest rate and term, resulting in a fixed monthly payment. A HELOC is a line of credit that can be drawn on at any time during the Draw Period, up to your credit limit. In contract to the Consumer Home Equity Loan, the HELOC has a variable rate, meaning your monthly payments may vary. Under a HELOC, you also have the option to convert variable-rate balances to fixed-rate balances.

You may pay online at FHB.com, set up automatic payments, or mail your payment to the following address:

First Hawaiian Bank

P.O. Box 29450

Honolulu, HI 96820-1850

You may also drop off your payment at any First Hawaiian Bank branch location.

No. A First Hawaiian Bank relationship is not required to apply/qualify.

You may apply via:

If you suspect that a transaction had been made without proper authorization, immediately contact your First Hawaiian Bank branch of account.

Yes. You may pay online with FHB Online & Mobile Banking or set up Automatic Payment from your First Hawaiian Bank Business Checking account.

You may pay your balance in full with no prepayment penalties or pay the minimum payment listed on your monthly statement.

Payments may be dropped off at any First Hawaiian Bank branch or mailed to the following address:

First Hawaiian Bank

P.O. Box 29450

Honolulu, Hawaii 96820-1850

To request a line increase, visit any First Hawaiian Bank branch.

Use checks to access the line of credit, without having to apply every time you need additional funds.

To report any lost checks, please contact your First Hawaiian Bank branch of account. Replacement checks will be mailed to you.

The Business Line of Credit is a revolving line of credit with a 3-year term, meaning it can be used for up to 3 years. Once the line reaches its maturity, any unpaid balances or fees become due.

The Business Line of Credit and associated terms are subject to credit approval and may vary depending on your financial situation.

This line of credit can be used for any business use. You can use it for short-term working capital, seasonal purchases, inventory, payroll, and other cash flow needs.

The Business Line of Credit cannot be used for personal, family or household purposes (or agricultural purposes for Guam residents), to finance the purchase or trading of securities, or to repay any debts incurred in the purchase or trading of securities, or to acquire, refinance, improve or maintain a 1-to-4 family residence.

No. A First Hawaiian Bank relationship is not required to apply/qualify for a Business FirstLine of Credit.

If you suspect that a transaction has been made without proper authorization, immediately contact us in Hawaii at 808-847-4444 or 1-800-342-2778 (Guam, Commonwealth of the Northern Mariana Islands or Continental US may call 1-800-342-2778).

As soon as you realize that your card has been lost or stolen, please contact us immediately through our 24 hour customer service line at (808) 847-4444 on Oahu, or toll free at 1 (800) 342-2778. A replacement card will be mailed to you.

Yes. You may pay online with FHB Online & Mobile Banking or set up Automatic Payment from your First Hawaiian Bank Business Checking account.

Payments may be dropped off at any First Hawaiian Bank branch or mailed to the following address:

First Hawaiian Bank

P.O. Box 29450

Honolulu, Hawaii 96820-1850

The Business Owner may contact his/her First Hawaiian Bank branch of account.

The Business Owner may contact his/her First Hawaiian Bank branch of account.

If you are approved, card(s) will be mailed 7 to 10 business days after your application has been processed. Additional cards will be mailed in separate envelopes.

No. A First Hawaiian Bank relationship is not required to apply/qualify for a Business Credit Card account.

You may apply via:

You may pay your balance in full or pay the minimum payment listed on your monthly statement.

Monthly earned Miles will be displayed on your First Hawaiian Bank credit card statement. Or, please visit the United website at www.united.com.

Currently, there is no limit to the amount of Miles you can earn. This may change subject to the rules of United's MileagePlus[[®]] program. For more information, please visit United's website at www.united.com.

To redeem your Miles, visit the United internet site at www.united.com or call 1-671-647-6453 in Guam or CMNI or 1-800-864-8331 (1-800-United-1) from all 50 states.

No, when you open a United World Elite Business Credit Card you are automatically enrolled in the MileagePlus[[®]] program if your address is in the U.S., Guam or CNMI.

You can apply for a United World Elite Business Credit Card at any First Hawaiian Bank branch in Guam or Saipan, or online.

No, there is no limit to the amount of CashPoints you can earn.

You can redeem your CashPoints for airline tickets by contacting our Redemption Center by phone or online. Search for flights online by logging into your account at www.fhbrewards.com and click the Book Travel link. You are free to book flights with any airline, subject to availability. If the ticket price exceeds your available CashPoints, you may charge the balance to your Priority Rewards or other valid credit card.

There is no annual membership fee for the Priority Rewards Business Credit Card.

You'll receive CashPoints for qualifying purchases. CashPoints can be redeemed for your choice of rewards like gift cards, airline tickets, hotel and rental car reservations, activities, merchandise, and even cash back! Use your card for all of your business purchases and watch your CashPoints add up!

The Priority Rewards Business MasterCard[[®]] earns accounts one (1) CashPoint[[SM]] for every one dollar ($1) of net purchases. Cash advances and balance transfers do not qualify to earn CashPoints. CashPoint earnings can be set up to be awarded to the individual cardholder or consolidated at the company level.

First Hawaiian Bank is the only local credit card processor in Hawaii. With First Hawaiian Bank your credit card processor and your bank are one in the same. No more being bounced around between a processor and a bank trying to figure out where or what the problem is. A single call to First Hawaiian Bank allows for easier troubleshooting and faster servicing should the need arise.

First Hawaiian Bank offers the following options for credit card acceptance:

First Hawaiian Bank offers the following benefits for credit card servicing:

When a customer writes a check at your business, ExpressCheck will print an authorization slip for the customer to sign, authorizing you to convert the customer's paper check into an electronic check. This allows you to submit an electronic entry to the customer's bank account instead of depositing the paper check. The cashier will return the paper check to the customer, along with a signed copy of the customer's authorization slip.

ExpressCheck provides advantages to both you and your customers:

| Merchant Benefit | Customer Benefit |

| No Returned Checks: SPS Guarantees (up to a pre-determined limit) all electronic checks | Increased Security: No paper check to lose, misplace, or copy. |

| No More Paper Checks: No more depositing or storage costs! | Informative: Customer’s statements will show your merchant name, date, and amount of transaction |

| Improved Cash Flow: Fund from ExpressChecks will be deposited into your account within two business days. | |

| No Return Item Fees |

A few of the more popular benefits of payroll servicing with First Hawaiian Bank, in conjunction with ADP and Ceridian Employer Services, include:

First Hawaiian Bank has partnered with Ceridian Employer Services and ADP to provide you with a whole spectrum of payroll services designed to help your business prosper. Our partners can help with more than just getting your employees paid; they can ensure the tax authorities have the right compensation and tax information at the right time.

Payroll services can file and pay your payroll taxes for you, and prepare valuable extra personnel reports, such as job cost accounting and labor distribution. Varying pay rates, bonuses, commissions, special payments, benefits and other deductions can also be accommodated easily.

Payroll services are available to all size businesses, from single-employee companies to the largest of corporations.

Existing QuickTax customers may log on to their accounts here by using their current access code and PIN number.

You should use QuickTax for the following reasons:

QuickTax offers the following benefits:

With QuickTax, you can eliminate unnecessary paperwork by paying your business taxes with your touchtone phone or using your PCs Internet connection. You'll no longer need to prepare tax deposit coupons, write checks or make extra trips to the bank. QuickTax also conforms to Electronic Federal Tax Payment System (EFTPS) requirements.

Let us show you the possibilities of how you can increase your store's profitability and your number of loyal customers with First Hawaiian Bank's Gift Card service. Provided together with our processing partners, the plastic, magnetic-striped cards are a great way to advertise your company, while making it convenient for your customers to make purchases year-round.

For more information, please call Business Services Sales at (808) 844-3151.

ACH Payments - Allows you to pay vendors, employees, or taxes electronically via the Automated Clearing House (ACH) utilized by banks. Using this method, most payees receive their payments in 2-days or less and reduces the processing of paper items and is less costly than mailing checks.Wire Transfer Service - Wire transfers are the fastest way to send funds both domestically and internationally. Wire transfers offer same day funds availability in most cases. Wires transfers can sent in US Dollars or Foreign Currencies using our FHB Online Business Center service or from our Branches.For more information, please call Business Services Sales at (808) 844-3151.

Mastercard 3D Secure 2.0 is an additional layer of authentication for online card transactions that aims to reduce fraud and enhance security. Not all transactions or purchases will require 3D Secure authentication; it depends on the merchant and/or type of purchase.

3D Secure may require a two-factor authentication to protect you from unauthorized or fraudulent transactions. The two-factor authentication will ask if you would like a passcode sent to your email or mobile phone and have you enter in the passcode. If you are able to authenticate your purchase using this method, the charge will go through. Otherwise, the transaction will be declined.

A 3D Secure authentication error may be due to a mistyped card number or an incorrect expiration date. You may need to reattempt the purchase to ensure all information needed to complete the transaction is correct. Also, if no authentication message was received, please double check that your mobile phone number and email address is correct on file with First Hawaiian Bank.

All of our First Hawaiian Bank consumer and small business debit and credit cardholders are automatically enrolled in Mastercard 3D Secure 2.0 as a security measure for our customers. There is no option to opt out.

At this time, 3D Secure 2.0 is not enabled for customers with a Commercial or Small Business roll up credit card.

3D Secure 2.0 only monitors for transactions in which your physical card is not present. When you use your physical card in person, 3D Secure 2.0 authentication is not triggered.

If you have questions about Mastercard 3D Secure, please call (808) 847-4444.

To update or reset your PIN, please do one of the following:

When opening a new credit or debit card account, your PIN will be mailed to your mailing address on file. It will be mailed separately from your card for security purposes and should arrive a day or two after your new card is received.

If you have not received your PIN after more than the timeline above, please contact FHB Customer Service Daily 7AM – 7PM HST at (808) 844-4444 or Toll-Free at (888) 844-4444 or visit the nearest branch for assistance.

There are many ways, including:

Note: Some features have additional fees. See terms & conditions for details.

Additional transaction fees may apply. Refer to the disclosures you received at account opening or inquire at a First Hawaiian branch.

To avoid holds, you can use:

A hold means that although we’ve received your check for deposit, you won’t be able to use the funds until the hold period has expired. Depending on the type of check that you deposit, funds may not be available until the third business day after the day of your deposit. However, the first $225 of your check deposits will be available on the first business day after the date of your deposit. If the deposited item is returned unpaid before the hold expires, those funds will not be made available to you. If the deposited item is returned after the hold expired, we charge your account for the amount of the item. Holds are placed to help protect both you and us from losses that could occur when a deposited item is returned unpaid. Situations that typically cause a check to be held include:

The speed with which we make your deposited funds available depends on a number of factors, including how, when, and where you made your deposit. For example:

To make a deposit by mail, send your check(s) to your branch of account. Please use our branch locator to find your branch of account’s address. Please do not mail cash.

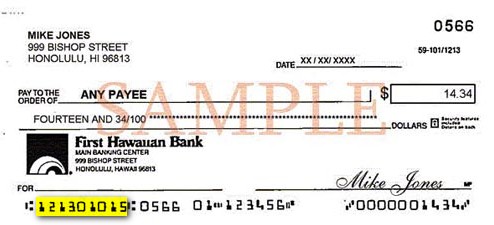

The sample check graphic below shows where the ABA routing number can be found on your check. The routing number is the first nine digits on the bottom left hand side of the check.

An Item Enclosure fee is charged when you receive a copy of your canceled checks with your statement. You may request to be added onto CheckStorage to avoid the Item Enclosure fee by contacting our customer service line at 1-888-844-4444.

A Check Image Service fee is charged for returning images of your canceled checks with your monthly statement. You can receive an online version of your statement which includes images of your canceled checks at no cost. To enable eStatements, login to FHB Online Banking and select your account, then click the Online Statement link. Follow the prompts on the screen to enable eStatements for each of your accounts. To enroll for FHB Online, go to fhb.com/enroll. Learn more about eStatements.

Please note that all the information provided by you must be exactly correct or the stop payment may not be effective. This order will not be effective if the bank has already cashed the item or is already committed to honor the item. A stop payment cannot be placed on an item that has already been presented. A fee of $30.00 will be charged to your account for this stop payment.

A scheduled transfer is a way of automatically moving money from your checking account to another checking or savings account each pay period.

To set up your Automatic Transfers, simply sign in to FHB Online service and click the "Transfer Funds" tab at the top of the page. Or, you can visit your nearest branch, where an associate will be happy to assist you.

You can enroll in Mastercard's ID Theft Protection by clicking "Activate Now" on the page here.

There is no charge for direct deposit. First Hawaiian Bank’s direct deposit is free of charge. No fee to setup direct deposit to any of your First Hawaiian Bank personal accounts - checking, savings, or money market account.

With your First Hawaiian Bank account number and the bank’s routing number or a voided check, go to your employer or the funding entity and request direct deposit. Most direct-deposit requests can be implemented by your next payday.

Direct deposit automatically places your paycheck, pension, Social Security, or other regular monthly income into your checking, savings, or Money Market account. It's convenient, secure, and saves trips to your branch.

You can go to FHBDestinations.com to view your Priority Miles balance and to make redemptions.

Your Priority Miles will remain active as long as you continue to use your Priority Destinations MasterCard for purchases or redeem your Priority Miles. Your Priority Miles will expire 2 years from your last purchase or your last redemption, whichever was most recent.

There is no cap on Priority Miles, so you can earn as many Priority Miles as you want.

(for World MasterCard cardholders): For more information on any of the travel, insurance, and retail protection services, see the Guide To Benefits that came with your Priority Destinations World MasterCard, or call 1-888-457-8537.

(for World Elite MasterCard cardholders): For more information on any of the travel, insurance, and retail protection services, see the Guide To Benefits that came with your Priority Destinations World Elite MasterCard, or call the VIP Desk at: 1-888-210-6123.

You can redeem your Priority Miles by visiting FHBDestinations.com. If you do not have internet access, you can call:

1-877-668-4662 (World cardholders)

1-877-676-5171 (World Elite cardholders)

Yes, either the primary or joint cardholder may redeem their combined CashPoints for their choice of rewards.

Yes, you may transfer your CashPoints to a friend's or family member's account by using the Transfer CashPoints page. The transferred CashPoints are set to the expiration date of the account receiving the CashPoints. To transfer your CashPoints, please log on to the website at www.fhbrewards.com, navigate to the Transfer CashPoints link on left navigation menu, and enter the recipient’s Priority Rewards card account number and last name.

The Priority Rewards[[SM]] Credit Card earns you one (1) CashPoint[[SM]] for every one ($1) dollar of net purchases. Cash advances and balance transfers do not qualify to earn CashPoints. Please refer to the Priority Rewards Program FAQs for more information on the Priority Rewards Program.

There is no cap on the amount of CashPoints you can earn per year on your personal Priority Rewards account.

No, our Priority Rewards program is unique to First Hawaiian Bank and you cannot combine them with airline frequent flyer miles or other loyalty programs to make redemptions or upgrade tickets.

Priority Rewards MasterCard accounts have the option of redeeming for a check or statement credit. Checks are made out to the primary and secondary (if applicable) cardholder on the account.

Yes, please call the Redemption Center at 1-800-868-2856.

YES! To receive airline frequent flyer miles, you should provide your airline frequent flyer number to the agent when you redeem your CashPoints. You must work directly with the airline in question if you forget to provide your frequent flyer number or in cases of any discrepancies.

You may redeem the appropriate level of CashPoints for any destination or class of service. Once a ticket is purchased by the Redemption Center, any upgrades or changes must be made between you and the airline which issued the ticket.

Your CashPoints will expire 24 months from your last credit card purchase or your last redemption, whichever is most recent. Transferred (gifted) CashPoints are set to the expiration date of the receiving account and do not count as redemption activity for the originating or receiving account.

You can log-on to our Redemption Website at www.fhbrewards.com or call our Redemption Center at 1-800-868-2856.

The details of your purchases and the number of CashPoints earned will be shown on your www.fhbrewards.com account. You will also be sent monthly email CashPoints statements to the email address you provide in your www.fhbrewards.com account profile.

Logging on to www.fhbrewards.com is fast and easy:

If you are a New User:

If you are a Returning User:

You'll receive CashPoints for qualifying purchases. Once you accumulate enough CashPoints, you can redeem them for your choice of rewards like gift cards, airline travel, hotel accommodations, cruises, even cash! Use your card for everyday purchases and watch your CashPoints add up!

You should have received an email notification with a link to “Verify Deposits”. You will be taken to a page where you will need to verify your identity. Once verified, you will be asked to enter the two small deposit amounts you received in your external account to complete the verification process. If you need additional assistance, please call us at (808) 844-4545 or toll free at (800) 894-5600, Monday to Friday from 8am - 5pm HST.

Please contact us at (808) 844-4545 or toll free at (800) 894-5600, Monday thru Friday between 8am – 5pm for assistance with your application.

Please confirm that the checking or savings account you are funding from has a higher available balance than the total deposit amount for your new account(s). If it doesn’t, you can either choose to fund from your account at another bank or by mailing in a check. If your current available balance is higher than your funding amount and you are still receiving an error, please contact us at (808) 844-4545 or toll free at (800) 894-5600, Monday to Friday from 8am - 5pm HST for assistance.

Once your new checking or savings account is opened online, you can enroll for and login to FHB Online Banking to view your new account and the full account number. You also receive a confirmation email with a link to view your new account(s). You will be taken to a page where you will need to verify your identity. Once verified, you can view detailed information about your new account(s).

Please contact us at (808) 844-4545 or toll free at (800) 894-5600, Monday to Friday from 8am - 5pm HST for assistance with opening a personal checking, savings or eCD account online.

If you ordered checks or a debit card when you opened your new account online, they should arrive within 10-12 business days to Hawaii, Guam or Saipan addresses.

If your account has already been opened and you want to order checks for the first time, please call our customer service at (888) 844-4444.

If you do not remember if you chose to order checks or a debit card during the online account opening process, please refer to your confirmation email with the link to view your account(s). From there, you will be taken to a page where you will need to verify your identity. Once verified, you can view detailed information about your new account(s) including if checks or a debit card was ordered. If you need additional assistance, please call us at (808) 844-4545 or toll free at (800) 894-5600, Monday to Friday from 8am - 5pm HST.

Yes-Check links your First Hawaiian Bank checking account to a line of credit – and automatically transfers available funds when your checking account doesn't have enough money to cover your transactions. This service gives you the flexibility to make payments when you don't have enough money in your checking account at the time of the transaction.

Yes, if the available balances in your checking account and Yes-Check are not enough to cover an item, you may be still be charged an Overdraft Fee (OD) or Non-Sufficient Funds (NSF) Return Item Fee.

No, you must apply for a separate Yes-Check line of credit for each checking account.

Please see a Customer Service Representative at a First Hawaiian Bank branch for current Rates and Fees.

You can apply for Yes-Check by visiting any First Hawaiian Bank branch.

To activate your card, please do one of the following:

If you suspect fraud on your account, please contact our 24 hour fraud service at (866) 686-4228 to report the transactions and request a replacement card. You may also opt into card alerts to monitor your account and transaction activity.

Yes, please inform FHB of your travel plans so that we can minimize cardholder disruption while you are traveling. To notify FHB of upcoming travel, please do one of the following:

To access or request a copy of your credit card statement, please do one of the following:

First Hawaiian Bank constantly strives to ensure the security of your account. If your card is ever lost or stolen, please contact us immediately through our 24 hour customer service line at (808) 847-4444 on Oahu, or toll free at 1 (800) 342-2778. This will prevent further transactions from being authorized on your card.

Your credit card expires on the last day of the month indicated on your credit card. Normally, replacement credit cards are sent during the month prior to the expiration date of your card. If your current card has expired and you did not receive your replacement, please contact us immediately by calling the number on the back of your card or on your statement. If you don’t have the numbers handy, our 24 hour customer service line is 1-800-342-2778. We will assist you in ensuring the safety of your account and help you order a replacement card.

Credit card customers can make a payment every 15 days using our fast, easy, and convenient phone payment service called "Quick Remit" by dialing the number on the back of your card. The availability of this service may be extended to once every 60 days if your last Quick Remit payment is returned. Payments must be made before 5:00pm Eastern Standard to reflect same day crediting. All payments made after 5:00pm EST will be credited as of the following business day.

Use your Priority Unlimited Mastercard® on purchases and automatically earn Cash Back. Cash Back will be earned when eligible transactions post to your account. You will earn 2% Cash Back on qualifying purchases if you have an additional qualifying FHB account OR 1.5% Cash Back if you do not. To qualify to receive 2% Cash Back on purchases, your additional qualifying FHB account must be open and in good standing when the transaction posts.

Cash Back can be redeemed as a statement credit through on-demand redemption, automatic monthly redemption or Mastercard Pay with RewardsTM, so long as your account is in good standing at the time the redemption is made.

MasterCard Pay with Rewards is a program that allows you to redeem statement credits towards eligible purchases.

When you redeem Cash Back, you will have to enter the amount you wish to redeem. The minimum redemption amount is $25.00. Cash Back cannot be bought, sold, or transferred.

A qualifying FHB account is any FHB personal deposit account (checking, savings, CD, IRA), mortgage, home equity loan, HELOC, or private banking relationship. You must be an owner of the qualifying account. Agents, beneficiaries, custodians, guardians, personal representatives, guarantors, and other types of non-owners are excluded. Cash Back is accumulated when eligible transactions post to the cardholder’s account.

The latest program agreements are available online at fhb.com. Click here for Priority Unlimited.

You can earn unlimited Cash Back on eligible purchases as long as your account is open and in good standing. See below for what constitutes an eligible purchase.

Eligible purchases are all purchase transactions excluding balance transfers, convenience checks, ATM withdrawals, PIN transactions, money transfers (including P2P payments), quasi cash transactions (including purchases of traveler’s checks, money orders, foreign currencies and cryptocurrencies), lease and loan payments, truck stop transactions, tax payments, gambling transactions, unauthorized or fraudulent charges, finance charges and other card-related fees. See the Priority Unlimited Program Agreement and the Priority Unlimited Credit Card Agreement at fhb.com/unlimited for additional details and restrictions.

In order to see your Priority Unlimited Cash Back activity online, you must register your account on www.fhbunlimited.com. Look for the Login/Register button on the site and follow the steps to register your account. You cannot register your account over the phone.

You will be emailed a monthly Cash Back balance as of the prior month's end, if you have registered your account at fhbunlimited.com. You can also log into fhbunlimited.com to see your Cash Back earnings, redemptions, and current balance.

Please call the Priority Unlimited Redemption Center toll-free at 833-251-6394.

For any questions about your Priority Unlimited balance, please call the Priority Unlimited Redemption Center toll-free at 833-251-6394.

For other questions about your Priority Unlimited credit card, please call (808) 874-4444 on Oahu or 1-800-342-2778 for the Neighbor Islands, Guam, Commonwealth of the Northern Mariana Islands (CNMI).

No, you will lose all of your Cash Back earnings if your account is closed.

Your Cash Back Balance cannot be assigned, transferred or pledged. If the Card Account is closed in connection with a death or incapacity of the Card Account owner, accumulated Cash Back does not constitute your property and cannot be bought, sold, or transferred in any way. This provision, however, does not apply to jointly held accounts where there is at least one surviving owner of an account.

All Credit, Debit, and ATM Cards are eligible to enroll in personalized card alerts except for the card types below.

Commercial Card and Business Credit Card accounts that begin with 5569, 5478, and 5199 will automatically receive a limited set of card alerts by email. No enrollment is required.

Visit this page for instructions.

You will receive a verification SMS text message confirming enrollment. If you did not receive the enrollment verification, please contact Customer Service at 1-800-342-2778. Phone numbers without the US country code (+1) are unable to receive card alert SMS text messages.

Manage card alert functionality is available only on the FHB Mobile app.

Card alerts can be personalized for each card on the account for purchase alerts (spend categories, spend limits, out-of-state purchases, online purchases), service alerts (card requests, card activations, above-threshold balances) and updates to card account (contact information).

To opt out of specific card alert(s), visit this page for instructions.

To opt out of all card alerts:

To re-enroll for specific card alert(s), visit this page for instructions.

To re-enroll to all card alerts:

Yes. You do not need to re-enroll in card alerts.

Yes, you will need to enroll in alerts for each credit or debit card.

Please call Customer Service at 1-800-342-2778 or the number on the back of your card.

To update your email address, update your profile with the new email address you would like to receive card alerts for.

To update your phone number, you will need to update your contact information for each card:

Phone numbers without the US country code (+1) are unable to receive card alert SMS text messages.

Mastercard 3D Secure 2.0 is an additional layer of authentication for online card transactions that aims to reduce fraud and enhance security. Not all transactions or purchases will require 3D Secure authentication; it depends on the merchant and/or type of purchase.

3D Secure may require a two-factor authentication to protect you from unauthorized or fraudulent transactions. The two-factor authentication will ask if you would like a passcode sent to your email or mobile phone and have you enter in the passcode. If you are able to authenticate your purchase using this method, the charge will go through. Otherwise, the transaction will be declined.

A 3D Secure authentication error may be due to a mistyped card number or an incorrect expiration date. You may need to reattempt the purchase to ensure all information needed to complete the transaction is correct. Also, if no authentication message was received, please double check that your mobile phone number and email address is correct on file with First Hawaiian Bank.

All of our First Hawaiian Bank consumer and small business debit and credit cardholders are automatically enrolled in Mastercard 3D Secure 2.0 as a security measure for our customers. There is no option to opt out.

At this time, 3D Secure 2.0 is not enabled for customers with a Commercial or Small Business roll up credit card.

3D Secure 2.0 only monitors for transactions in which your physical card is not present. When you use your physical card in person, 3D Secure 2.0 authentication is not triggered.

If you have questions about Mastercard 3D Secure, please call (808) 847-4444.

Go to our Support section for detailed instructions on how to Update Your Username or Password.

If you forgot your password, you can reset your password online by clicking on the "Forgot Your Password?" link at fhb.com or using the FHB Mobile app. We will ask you to verify your identity via security code or by answering your security questions.

If you forgot your username, you can use the "Forgot Your Username" link at fhb.com or on the FHB Mobile app, to recover your username. A link will be sent to your email address on file and you will be sent a security code via text or phone call to verify your identity. Once verified, your username will be displayed.

If you have already tried this and still need assistance, call 643-4343 (1-888-643-4343 from the Continental U.S., Guam, and CNMI). Too many failed login attempts will lock you out of your online banking account.

Once logged in to FHB Online, go to "Settings" then click "Profile". There you can update your email address and phone number. If you would like to change the address on any of your accounts, please Send a Secure Message in FHB Online by clicking the "Messages" link. Select "Change of Address" from the subject line drop down menu, then include your new address and each bank account that should be updated with the new address.

Go to our Alerts & Notification page for detailed instructions on how to Create and Manage Your Alerts

The current balance is the total amount of funds in your account. The available balance is your current balance less any outstanding holds or debits that have not yet posted to your account.

With Online Banking you will be able to view 45 days of history for your deposit accounts; however, credit card accounts will show only history from the day you enrolled. As transactions post to your account, you can view them going forward. You will eventually be able to see as much as 36 months of past activity and 7 years of eStatements on your accounts. The amount of account activity information may vary when accessing the information via Quicken/QuickBooks. The FHB Mobile app displays up to 90 days of transaction history.

If you need immediate attention, such as technical issues, stopping a payment on a Paper Check, reporting a lost or stolen card, or reporting an unauthorized transaction from one of your Accounts, call us at 844-4444 (or 1-888-844-4444 from the Continental U.S., Guam, and CNMI). For all other inquiries, please contact us through the Message section of your FHB Online service and we will respond within a few business days.

To enable fingerprint or facial login, please follow this guide in our Support section.

The FHB Mobile app offers facial or fingerprint authentication on supported iPhone®, iPad® and AndroidTM devices. All registered fingerprints and face IDs on the mobile device will be able to login.

The FHB Mobile app is available for many smartphones and tablets including iPhone, iPad, and Android devices. For mobile deposit, auto-focus must be supported on your device. Please see below for a list of the operating systems that are supported for the FHB Mobile app.

If you confirmed you are using a supported operating system and continue to experience issues with the mobile app please contact customer service at (808) 643-4343 or toll-free at (888) 643-4343.

FHB Online

Click on "Statements" then select "View Statements". Select the account and the month of the statement you would like to view, then click the "View and print document" button. We also recommend that you disable any pop-up blocking software enabled on your web browser.

FHB Mobile

You must first be enrolled for eStatements in FHB Online Banking under Statements > Preferences, before you are able to view eStatements in the FHB Mobile app.

No. Online check images are provided as an additional service to assist you with your banking needs. This will not change the way you currently receive your statements.

Go to our Support section for detailed instructions on how to manage eStatements.

Yes. Each time a new statement is available, you will be sent an email notification to the email address in your Online Banking profile. Should your email address change, please update your information by going to "Settings" then "Profile".

Statements are available online from 2022 onward and will be stored for up to seven years. Paper copies of older statements can be requested by sending us a secure message with the subject “Statement Copy Request”.

Statements are generally available for viewing 48 hours after the statement cut-off date (please allow additional time for weekends and holidays). If it's within 48 hours from the statement cut-off date, please contact customer service at 888-844-4444 for assistance. Or, if you have a combined statement, like with the paper statement, all combined account information will show up on a single statement listed under the primary account number (not under each individual account number).

Please note that for credit cards, you may not have a statement if your balance is zero and there were no transactions during the billing period.

Zelle[[®]] is a fast, safe and easy way to send money directly between almost any bank accounts in the U.S., typically within minutes[[#1]]. With just an email address or U.S. mobile phone number, you can send money to people you trust, regardless of where they bank[[#2]].

You can send, request, or receive money with Zelle[[®]].

If you have already enrolled with Zelle[[®]], you do not need to take any further action. The money will be sent directly to your bank account and will be available typically within minutes[[#1]].

If you have not yet enrolled with Zelle[[®]], follow these steps:

Zelle[[®]] is a great way to send money to family, friends, and people you are familiar with such as your personal trainer, babysitter or neighbor[[#2]].

Since money is sent directly from your bank account to another person's bank account within minutes[[#1]], Zelle[[®]] should only be used to send money to friends, family and others you trust.

Neither First Hawaiian Bank nor Zelle[[®]] offers a protection program for any authorized payments made with Zelle[[®]] – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

It's easy — Zelle[[®]] is already available within First Hawaiian Bank’s online banking and mobile banking app. Download the FHB Mobile app or sign-in online and follow a few simple steps to enroll with Zelle[[®]] today.

No, First Hawaiian Bank does not charge any fees to use Zelle® in the FHB Mobile app for personal customers.

Business customers must be enrolled for FHB Online Business Banking to use Zelle® with a small business checking account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle® and Entitlements. See FHB Online Terms & Conditions for details.

Your mobile carrier’s messaging and data rates may apply.

You can find a full list of participating banks and credit unions live with Zelle[[®]] here.

If your recipient's financial institution isn't on the list, don't worry! The list of participating financial institutions is always growing, and your recipient can still use Zelle[[®]] by downloading the Zelle[[®]] app for Android and iOS.

To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number, and a Visa[[®]] or Mastercard[[®]] debit card with a U.S. based account (does not include U.S. territories). Zelle[[®]] does not accept debit cards associated with international deposit accounts or any credit cards.

When you enroll with Zelle[[®]] through your online banking account, or mobile banking app, your name, the name of your bank, and the email address or U.S. mobile number you enrolled is shared with Zelle[[®]] (no sensitive account details are shared – those stay with First Hawaiian Bank).

When someone sends money to your enrolled email address or U.S. mobile number, Zelle[[®]] looks up the email address or mobile number in its "directory" and notifies First Hawaiian Bank of the incoming payment. First Hawaiian Bank then directs the payment into your bank account, all while keeping your sensitive account details private.

In order to use Zelle[[®]], the sender and recipient's bank accounts must be based in the U.S.

You can only cancel a payment if the person you sent money to hasn't yet enrolled with Zelle[[®]]. To check whether the payment is still pending because the recipient hasn't yet enrolled, you can go to your activity page, choose the payment you want to cancel, and then select "Cancel This Payment."

If the person you sent money to has already enrolled with Zelle[[®]], the money is sent directly to their bank account and cannot be canceled. This is why it's important to only send money to people you trust, and always ensure you've used the correct email address or U.S. mobile number when sending money.

If you sent money to the wrong person, we recommend contacting the recipient and requesting the money back. If you aren't able to get your money back, please call customer service at (888) 643-4343 so we can help you.

Scheduled or recurring payments sent directly to your recipient’s account number (instead of an email address or mobile number) are made available by First Hawaiian Bank but are a separate service from Zelle® and can take 1 – 3 business days to process.

You can cancel a payment that is scheduled in advance if the money has not already been deducted from your account.

Money sent with Zelle[[®]] is typically available to an enrolled recipient within minutes[[#1]].

If you send money to someone who isn't enrolled with Zelle[[®]], they will receive a notification prompting them to enroll. After enrollment, the money will be available in your recipient's account, typically within minutes[[#1]].

If your payment is pending, we recommend confirming that the person you sent money to has enrolled with Zelle[[®]] and that you entered the correct email address or U.S. mobile phone number.

If you're waiting to receive money, you should check to see if you've received a payment notification via email or text message. If you haven't received a payment notification, we recommend following up with the sender to confirm they entered the correct email address or U.S. mobile phone number.

Still having trouble? Please contact customer services at (888) 643-4343.

Yes! They will receive a notification via email or text message.

Keeping your money and information safe is a top priority for First Hawaiian Bank. When you use Zelle[[®]] within our mobile app or online banking, your information is protected with the same technology we use to keep your bank account safe.

If you don't know the person or aren't sure you will get what you paid for (for example, items bought from an online bidding or sales site), you should not use Zelle[[®]] for these types of transactions.

These transactions are potentially high risk (just like sending cash to a person you don't know is high risk). Neither First Hawaiian Bank nor Zelle[[®]] offers a protection program for any authorized payments made with Zelle[[®]] – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

Your email address or U.S. mobile phone number may already be enrolled with Zelle[[®]] at another bank or credit union. Call our customer service team at (888) 643-4343 and ask them to move your email address or U.S. mobile phone number to First Hawaiian Bank so you can use it for Zelle[[®]].

Once customer support moves your email address or U.S. mobile phone number, it will be connected to your First Hawaiian Bank account so you can start sending and receiving money with Zelle[[®]] through the First Hawaiian Bank mobile banking app and online banking. Please call First Hawaiian Bank’s customer support toll-free at (888) 643-4343 for help.

Zelle[[®]] is a fast and easy way for small businesses to send, request, and receive money directly between eligible bank accounts in the U.S.[[#4]] If your customers use Zelle[[®]] within their mobile banking app, they can send payments directly to your First Hawaiian Bank checking account with just your email address or U.S. mobile number. With Zelle® payments typically arrive within minutes[[#1]] .

You can send, request, or receive money with Zelle[[®]]. To get started log into FHB Online Banking or the FHB Mobile app, go to “Payments” and select “Send Money with Zelle[[®]]”. Enter your email address or U.S. mobile number, receive a one-time verification code, enter it, accept terms and conditions, and you’re ready to start sending and receiving with Zelle[[®]].

When you use Zelle[[®]] with a business checking account, you can send money to other small businesses with an eligible account at a financial institution that offers Zelle[[®]] to small businesses. You can also send money to consumers that have access to Zelle[[®]] through their mobile banking app. At this time, we don’t support sending to (or receiving from) consumers that are only enrolled in the Zelle[[®]] app[[#5]].

If the small business or consumer you send money to has already enrolled with Zelle[[®]] through their bank’s mobile app, the money is sent directly to their bank account and the transaction cannot be canceled. It’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

You can receive payments from consumers using Zelle[[®]] through their bank’s mobile app. You can also receive payments from other small businesses if their financial institution offers Zelle[[®]] to small businesses. At this time, you’re not able to receive payments from consumers that are only enrolled in the Zelle[[®]] app[[#5]].

Once you’re enrolled with Zelle[[®]] the money you receive is typically available within minutes.

First, you should enroll your email address or U.S. mobile number with Zelle[[®]] through your mobile banking app and associate it with your business checking account. Second, share your enrolled email address or U.S. mobile number with your customers and ask them to send you payment with Zelle[[®]] right from their banking app. You don’t need to share any sensitive account details; they can send you money by using your enrolled email address or U.S. mobile number to identify you. After the consumer sends you payment with Zelle[[®]], you will receive your money directly into your enrolled checking account.

You can also request payments directly through the FHB Mobile app by clicking on “Payments” then “Send Money with Zelle[[®]]”. Select “Request,” entering your customer’s email address or U.S. mobile number, confirming the recipient is correct (make sure you’ve entered the correct email address or U.S. mobile number of the person or business you want to request payment from) and tapping “request”.

If your customer is using Zelle[[®]] through their bank’s mobile app, they’ll be able to pay you with Zelle[[®]]. You’ll receive a payment notification once your customer has sent you money in response to your request. If your customer is enrolled in the Zelle® app[[#5]], they will not be able to send you money with Zelle[[®]], and you should arrange for a different payment method.

There are a few ways you can encourage your customers to pay you with Zelle[[®]].

Please note, you’ll only be able to receive payments from consumers using Zelle[[®]] through their financial institution’s mobile banking app. You will not be able to receive payments from consumers enrolled in the Zelle[[®]] app.

To request money with Zelle[[®]], login to FHB Online or the FHB Mobile app and go to “Payments” then select “Send Money with Zelle[[®]]”. Choose “Request,” select the individual from whom you’d like to request money, enter the amount you’d like to request, include an optional note, review and hit “Request”.[[#3]]

Neither First Hawaiian Bank nor Zelle[[®]] offers a protection program for any authorized payments made with Zelle[[®]] – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

You must be enrolled for FHB Online Business Banking to use Zelle[[®]] with a small business account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle[[®]] and Entitlements. See FHB Online Terms & Conditions for details.

Whether you use Zelle[[®]] with a business account or a consumer account, Zelle[[®]] uses the same network to initiate payments to small businesses and consumers. Consumers who are already enrolled with Zelle[[®]] through their mobile banking app don’t need to do anything different to send money to a small business – they use the existing Zelle[[®]] experience they already know and trust within their bank’s mobile app. However, the experience is slightly different for small businesses[[#4]], as small businesses cannot currently send payments to or receive payments from consumers who are only enrolled in the Zelle[[®]] app.

You must be enrolled for FHB Online Business Banking to use Zelle[[®]] with a business checking account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle[[®]] and Entitlements. See FHB Online Terms & Conditions for details.

You must be enrolled for FHB Online Business Banking to use Zelle[[®]] with a business checking account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle[[®]] and Entitlements. Please review the updated terms and conditions that were provided by First Hawaiian Bank.

To get started, log into FHB Online or the FHB Mobile app. If both your personal and business accounts are available in your FHB Online profile, you can select the appropriate checking account when sending a payment.

If you have a separate login for your personal and business accounts or are enrolled with Zelle[[®]] at another financial institution, you must use a different U.S. mobile number or email address than the one you used to enroll your personal bank account with Zelle[[®]]. For example, aloha@email.com would be connected to your personal checking account, and 555-555-1234 would be connected to your small business account.

No, Zelle[[®]] does not integrate directly with accounting software at this time. However, since Zelle[[®]] is connected to your bank account, you are able to see all Zelle[[®]] transactions in your online banking transaction records. If your bank account transactions feed into accounting software, you will see the Zelle[[®]] transactions.

You must be enrolled for FHB Online Business Banking to use Zelle[[®]] with a business checking account. FHB Online Business Banking is FREE for Priority Banking customers and $5.99 for all other customers. FHB Online Business Banking includes online banking, mobile banking, online Bill Pay, Zelle[[®]] and Entitlements.

Please contact us at (888) 643-4343 for assistance.

You can only cancel a payment if the small business or consumer you sent money to hasn’t yet enrolled with Zelle[[®]]. To check whether the payment is still pending because the recipient hasn’t yet enrolled, you can go to your activity page, choose the payment you want to cancel, and then select “Cancel This Payment.”

If you send money to a small business or consumer that has already enrolled with Zelle[[®]] through their bank or credit union’s mobile app, the money is sent directly to their bank account and cannot be canceled. This is why it’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

If you try to send money to a consumer who is enrolled in the Zelle[[®]] app[[#5]], the payment won’t go through and a message will pop up to let you know the payment cannot be completed. With small business accounts, Zelle[[®]] does not currently support sending money to users enrolled in the Zelle[[®]] app.

If you sent money to the wrong person, please contact us immediately at (888) 643-4343 for assistance.

Yes, for security reasons we limit the amount of money you can send through Zelle[[®]]. You can view your daily and monthly (30-day period) Zelle[[®]] send limits by logging in to FHB Online or the FHB Mobile app. Once in Zelle[[®]], select a contact that you want to send money to then click on the question mark next to “Limits”. We may change these limits at our sole discretion.

Yes, for security reasons we limit the amount of money you can send through Zelle[[®]]. You can view your daily and monthly (30-day period) Zelle[[®]] send limits by logging in to FHB Online or the FHB Mobile app. Once in Zelle[[®]], select a contact that you want to send money to then click on the question mark next to “Limits”. We may change these limits at our sole discretion.

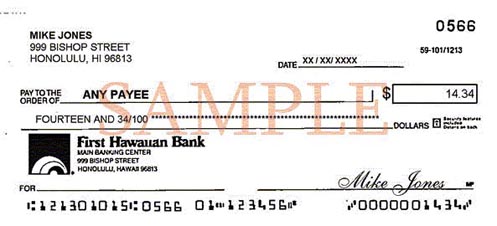

Sample of CheckImage Front

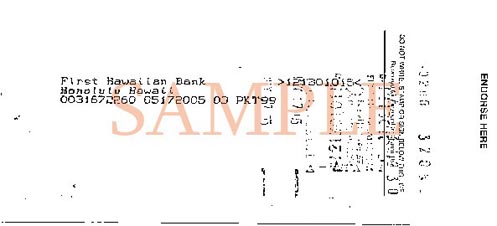

Sample of CheckImage Back

No. Online check images are provided as an additional service to assist you with your banking needs. This will not change the way you currently receive your statements.

Images of cleared checks are available in the Account Details section by clicking on the check number of the check you wish to view. You then have the option to view or print both sides of the check. Special software is not necessary to view check images online. However, we do recommend that you disable any pop-up blocking software enabled on your web browser.

CheckImage is available to all customers enrolled in FHB Online service allows you to view and print images of the front and back of checks that have cleared your Checking account. Online check images through FHB Online are usually available within one business day after the checks have cleared your account. When you enroll in FHB Online, you will automatically have the ability to view images of checks online for no additional cost.

Images of checks that you have written are available through FHB Online as long as the check transactions appear in your Account Details. Special check image requests can be requested by sending us a Secured Message through FHB Online.

Insurance policies don’t typically have a “balance.” Depending on the type of policy, they may have a cash value but this information is not displayed. Please contact your Account Officer if you have questions about your policy.

Although TotalWealth[[®]] and FHB Online both provide online access to wealth management account information, the available information and features are different. Please contact your Account Officer to discuss which service may best fit your needs (e.g., if you are a business customer).

Go to the enrollment page and follow the instructions to determine the best enrollment process for you.

Once enrolled, you will be able to view a list of your organization’s accounts and balances, but you will not be able to view detailed information on the accounts. If you would like access to more information, please contact your Account Officer to discuss alternatives that may be available to you. If you need assistance with identifying your account manager, please call 808-525-7027 for assistance with your Wealth Management Account.

FHB Online uses several methods to protect your accounts. Techniques we use include stringent password requirements, and two-step authentication.

Passwords – Passwords must be a minimum of 9 characters and a maximum of 32 characters. We require at least one upper-case and lower-case letter and one number. Certain special characters are allowed but not required.

Secure Access Code (SAC) is a method we use to verify your identity once you have provided your login credentials. Our system will ask to send a Secure Access Code to your phone number or email address on your profile and you will need to enter this code in order to proceed.

To access your accounts and pay bills through FHB Online, you must use a browser that supports 128-bit encryption security. Additionally, certain features of FHB Online are best experienced with the latest versions of Google Chrome, Microsoft Edge, FireFox or Safari.

Once logged into FHB Online, go to “Settings” then click on "Security Preferences" and "Secure Delivery". You are able to add multiple phone numbers and email addresses that can be used to verify your identity when logging in.

Yes. You can access FHB Online from any computer. Remember to always logout when you are done using the service and never to share your username or password with anyone.

We recommend you download the FHB Mobile app before your departure. Once you login to the mobile app it will verify your identity by sending a Secure Access Code.